Top 5 Best Shopify Tax Apps [November, 2024]

This guide helps ecommerce store owners to compare and find the best Tax apps for Shopify. Tax apps are popular for ecommerce businesses that want a more comprehensive tool for managing local tax in specific regions around the world. However, with the variety of Shopify apps for Tax, it can be challenging to find the ideal app for store owners’ individual needs.

To help ecommerce store owners make the right choice, the attributes of available Shopify apps have been assessed considering: features, price, free trial availability, app store rating and free app options.

This guide compares five companies for merchants to review and find the optimal Tax app for their needs. To help them make an informed decision, a quick comparison table of the best Tax Shopify apps is shared below, followed by in-depth reviews and frequently asked questions.

Free Guide: How To Find A Profitable Product To Sell Online

Excited about starting a business, but not sure where to start? This free, comprehensive guide will teach you how to find great, newly trending products with high sales potential.

Quick comparison of the best Shopify Tax apps

| # | App Name | Developer Name | Pricing | Rating | Free Trial | Image | Action |

|---|---|---|---|---|---|---|---|

| 1 | TaxJar Sales Tax Automation | TaxJar | $5/month | 2.7/5 ⭐️ | yes |  |

Get app |

| 2 | Tax Rex – Sales Tax Automation | Rexific Apps | $5/month | 5/5 ⭐️ | yes |  |

Get app |

| 3 | Sidr – Sales Tax Automation | Sidr | $19/month | 5/5 ⭐️ | yes |  |

Get app |

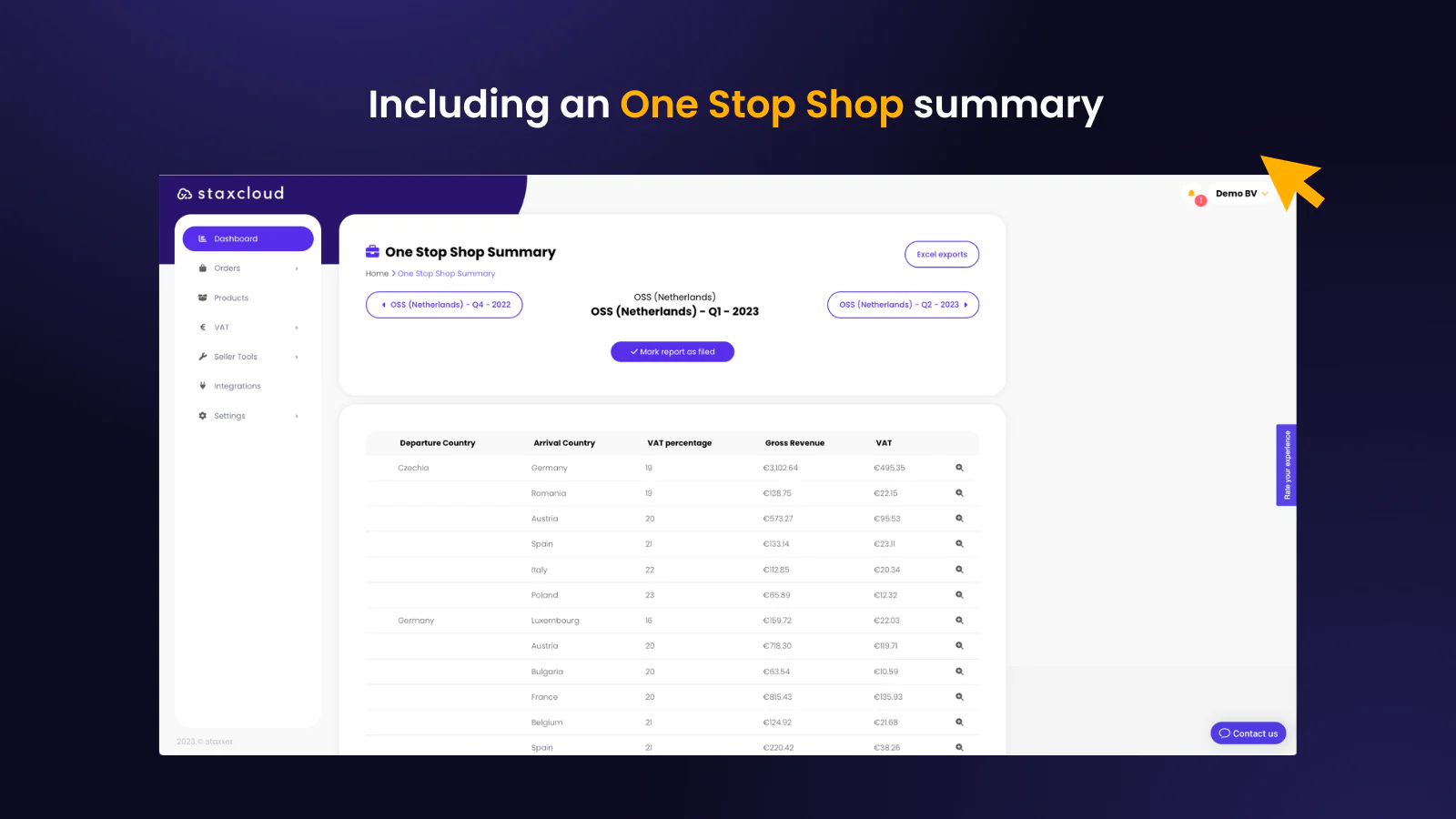

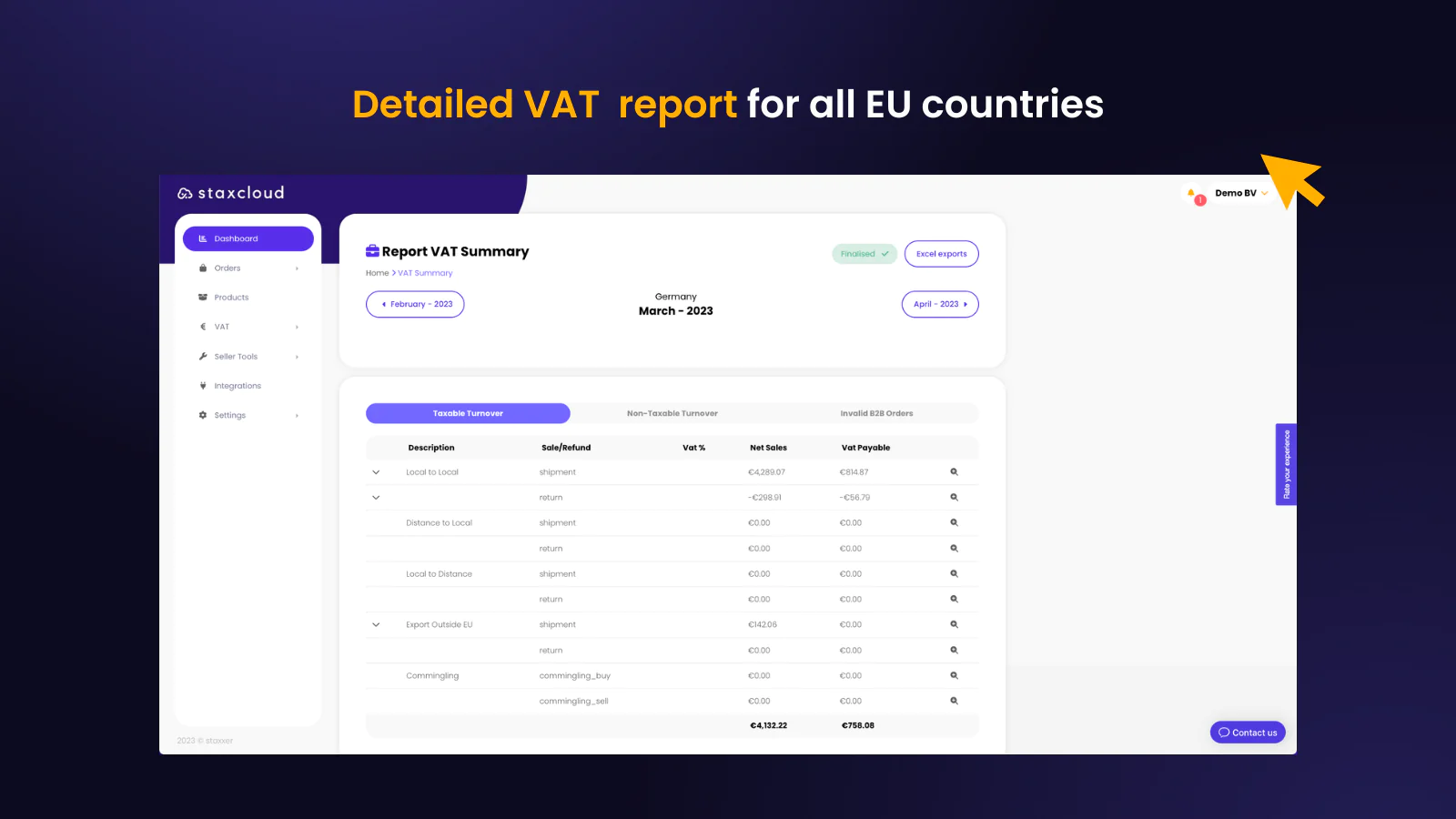

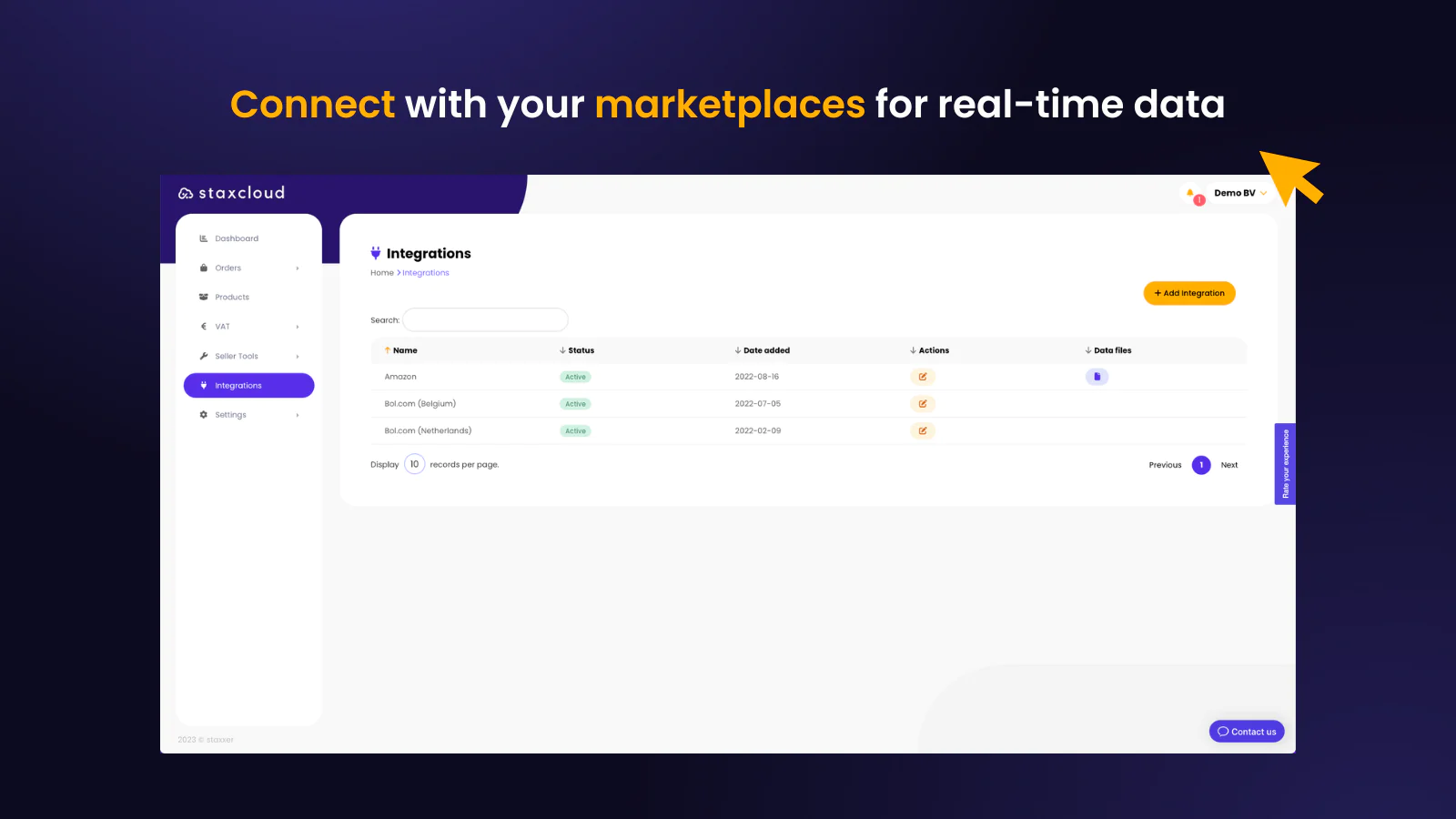

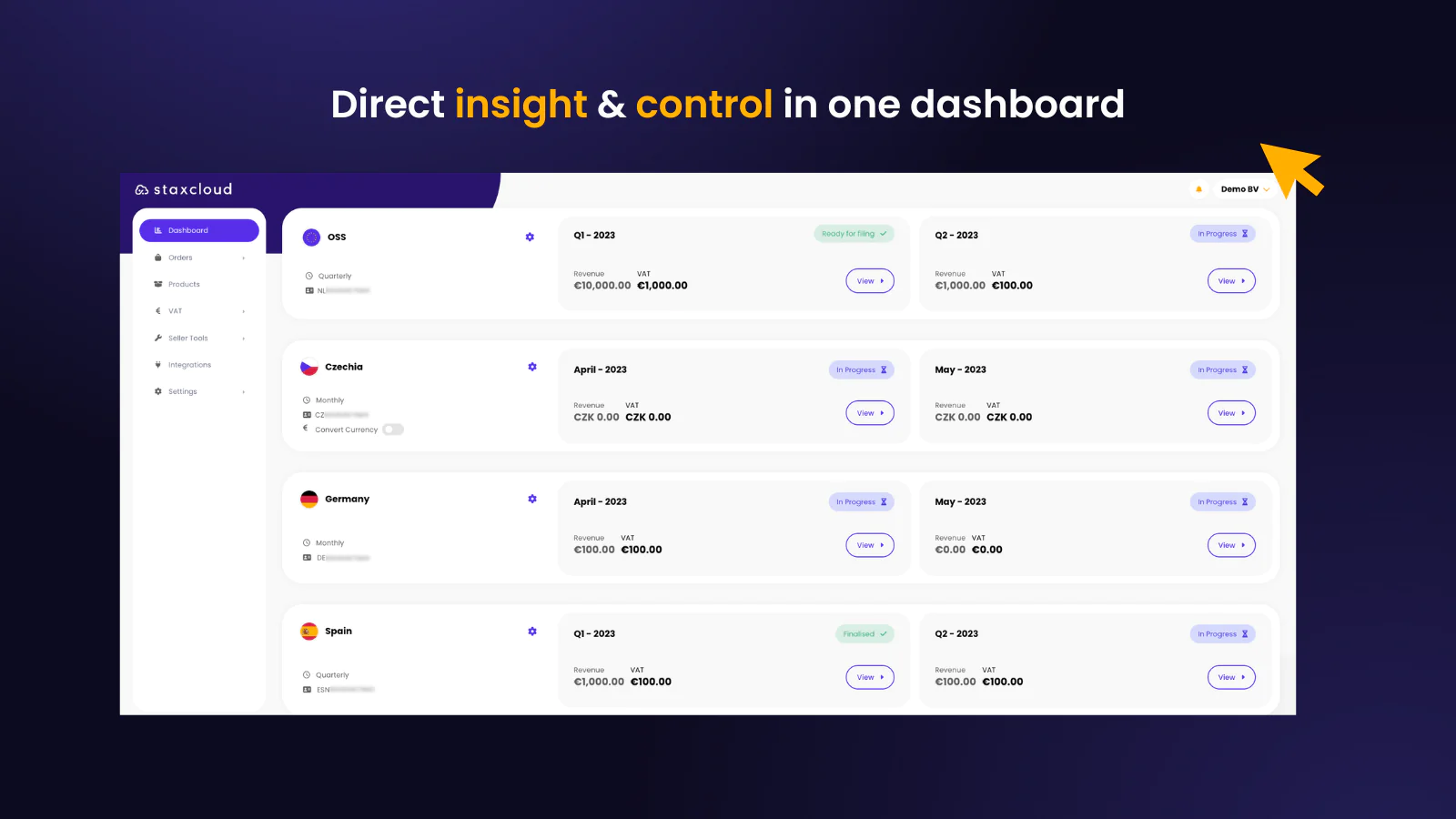

| 4 | Staxcloud | Staxxer B.V. | $21/month | 5/5 ⭐️ | yes |  |

Get app |

| 5 | TaxCloud’s Simple Sales Tax | TaxCloud | $9/month | 5/5 ⭐️ | no |  |

Get app |

Top Shopify Tax apps reviewed

Table of contents:

How to Find The Best Tax Shopify App?

These five Tax apps for Shopify are ranked based on the following criteria:

- Features

- Price

- Rating on the Shopify app store

- Free trial availability

- Free app options

- Compatibility with other top apps

- Number of apps the app provider operates

- Pros and cons

- Built for Shopify badge

- Reviews and assessment by AcquireConvert

What are Shopify Tax apps?

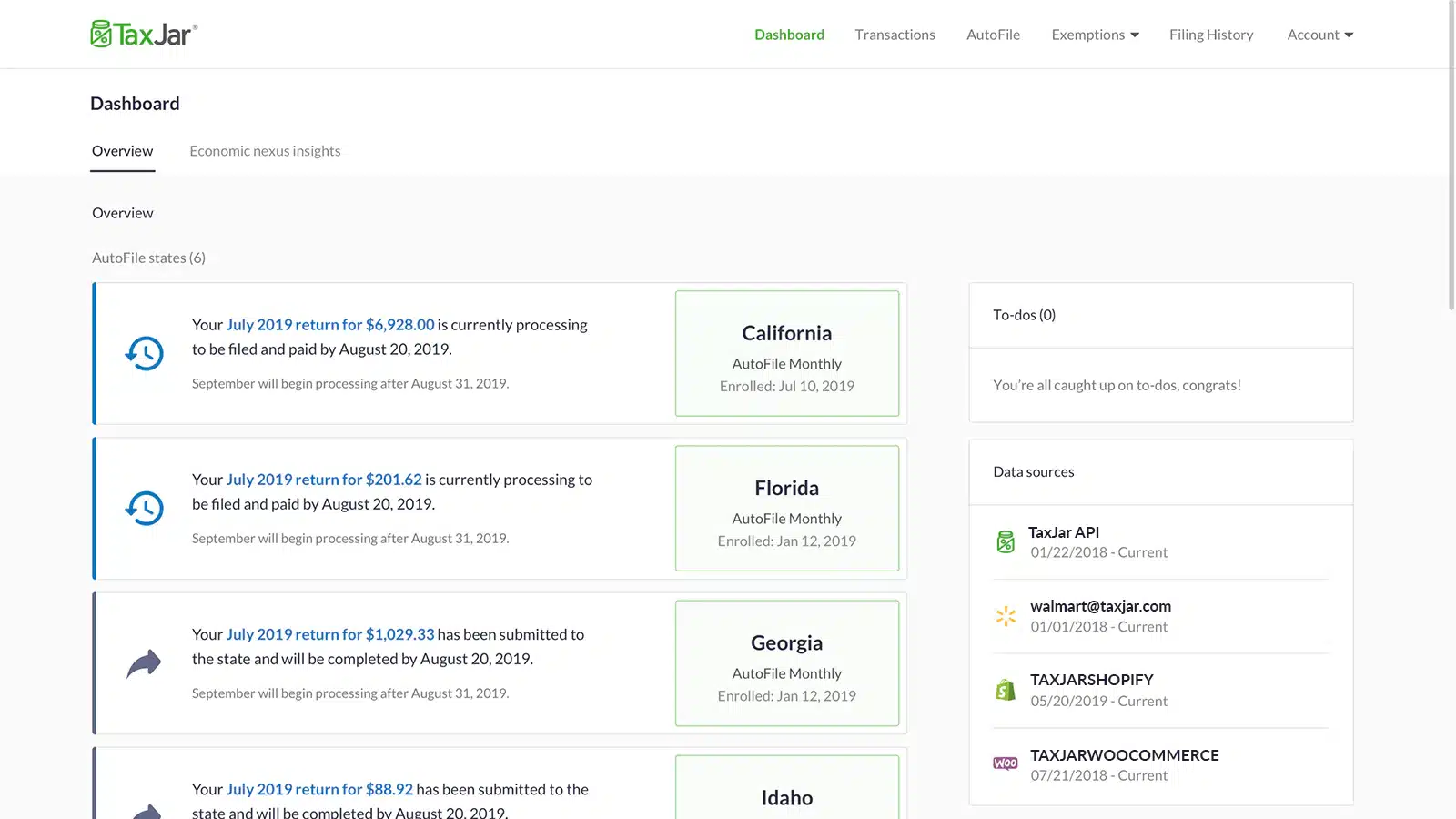

Shopify Tax apps serve as essential tools for e-commerce businesses seeking to navigate the complexities of tax compliance efficiently. Integrated into the Shopify ecosystem, these apps automate crucial tax-related processes, from calculating the correct sales tax for every order to ensuring accurate tax reporting and filing. Designed to handle the intricacies of local, state, federal, and international tax regulations, Shopify Tax apps eliminate the need for manual tax calculations, significantly reducing the risk of errors and non-compliance.

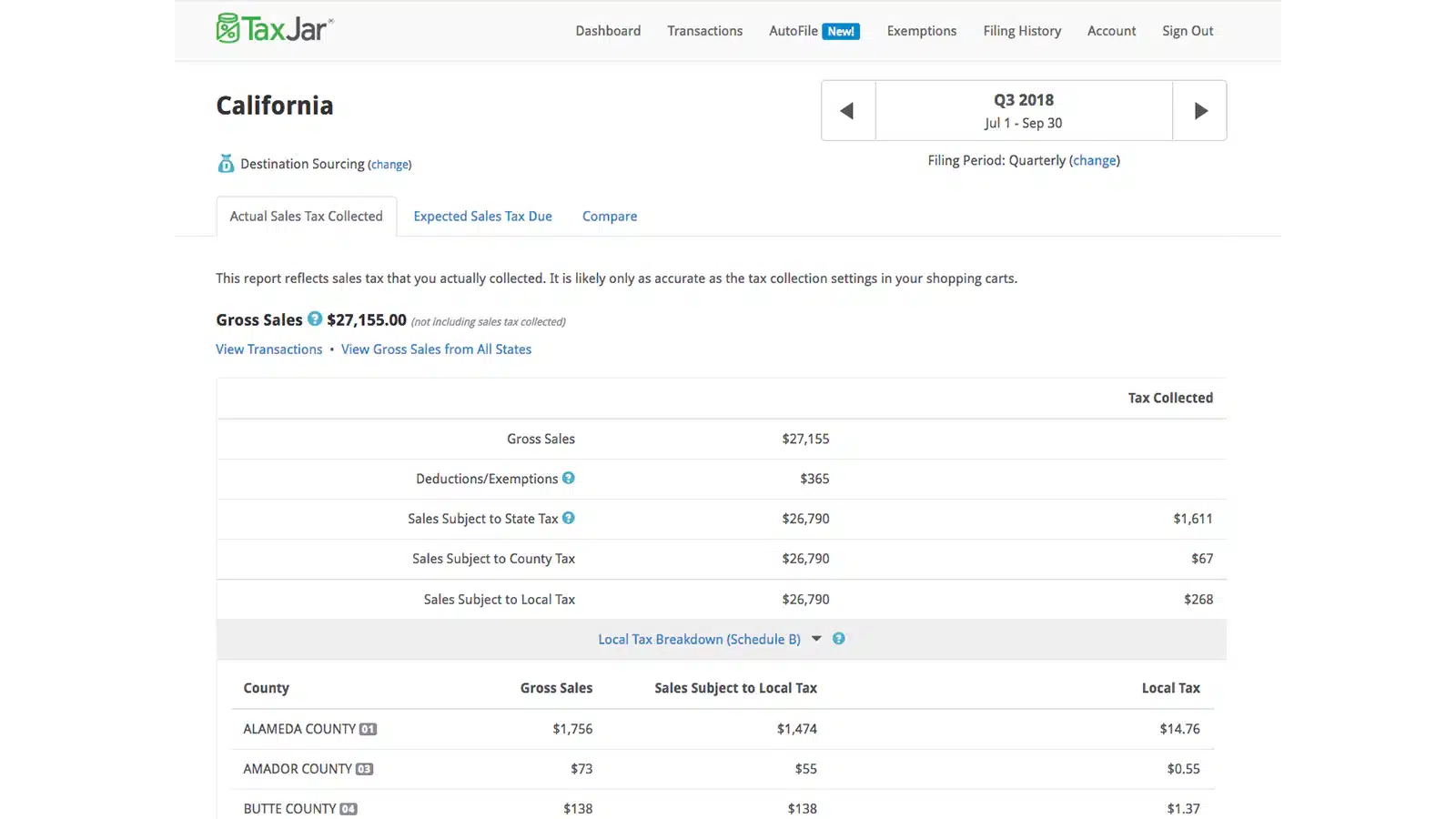

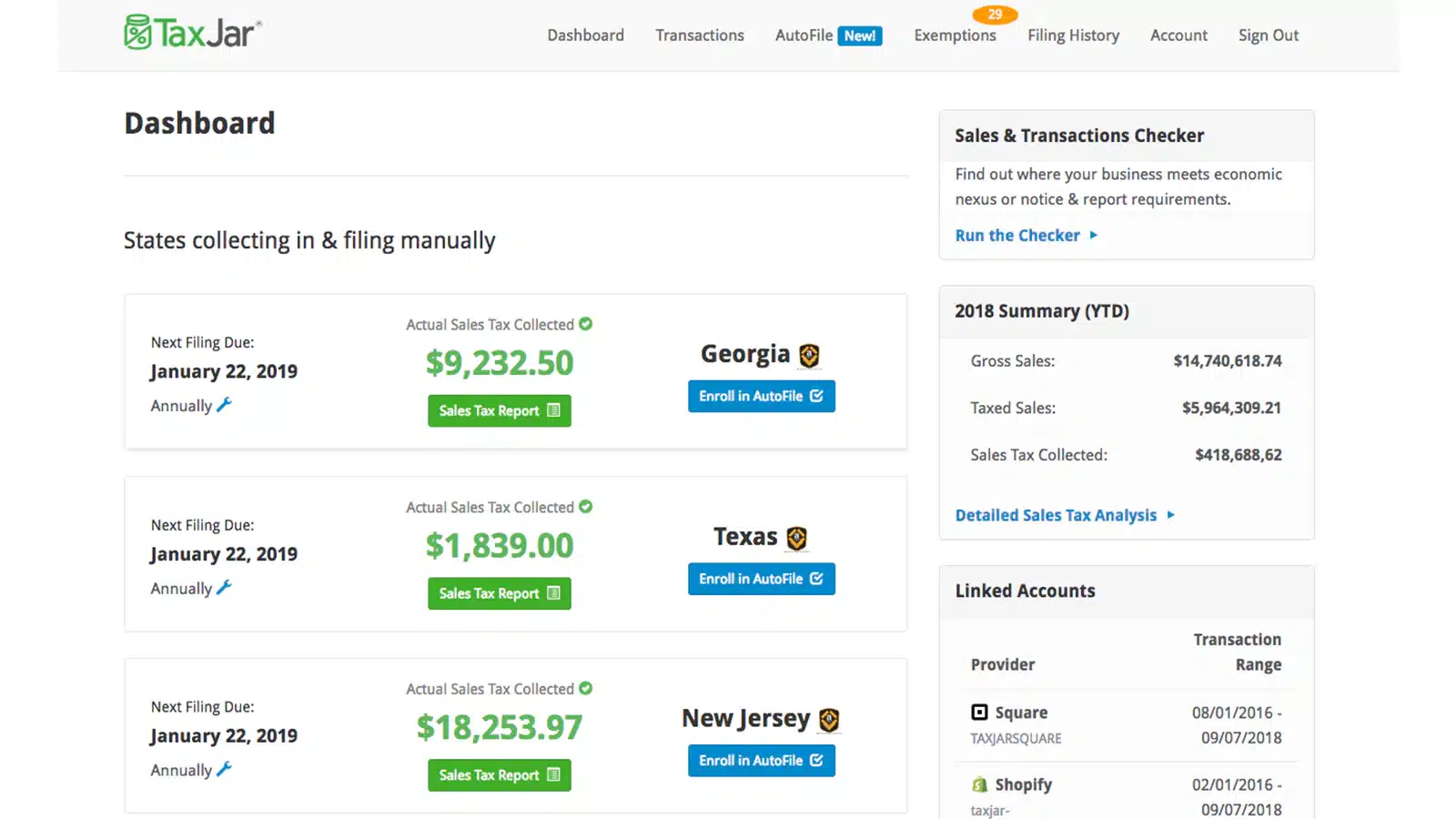

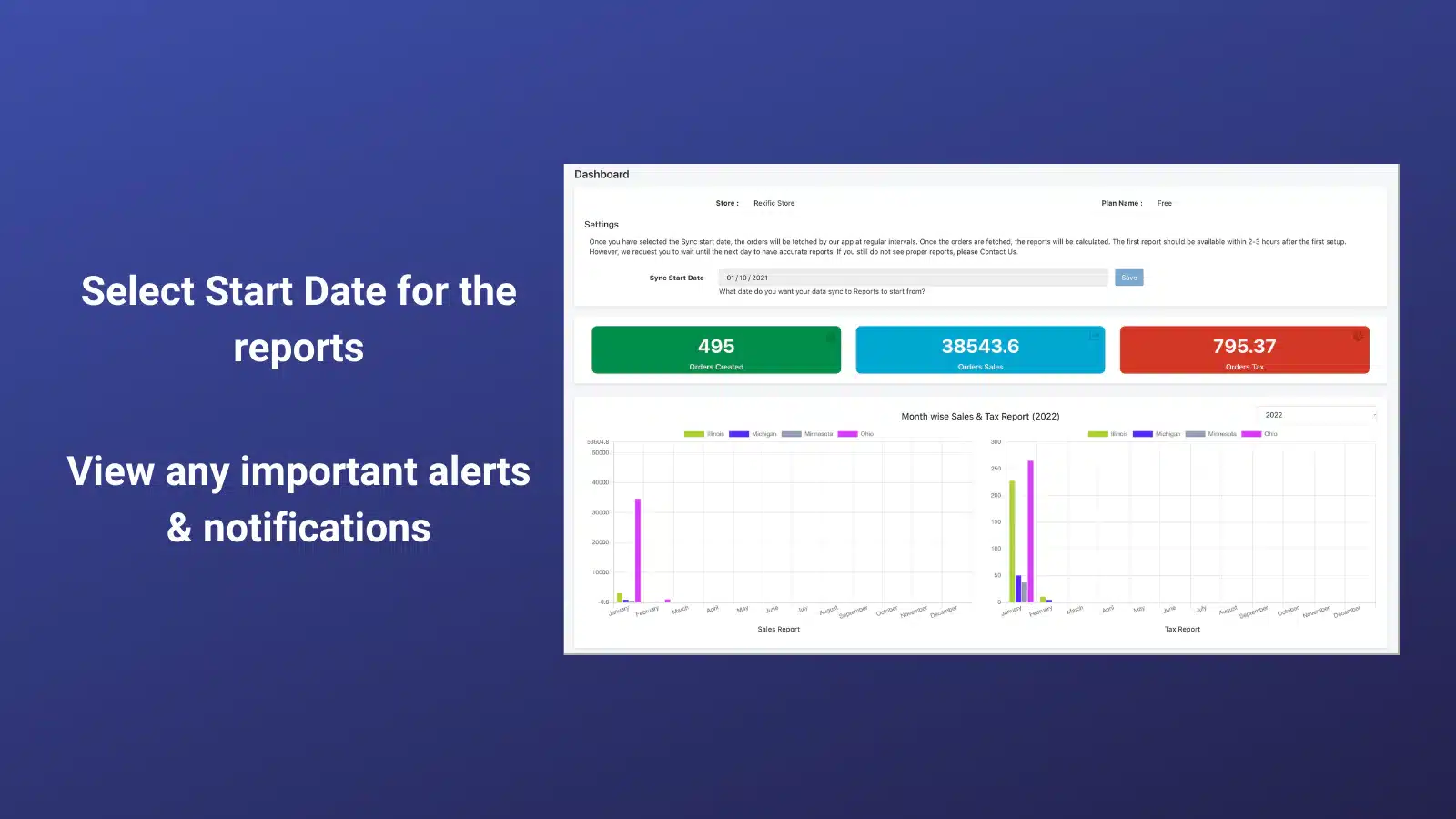

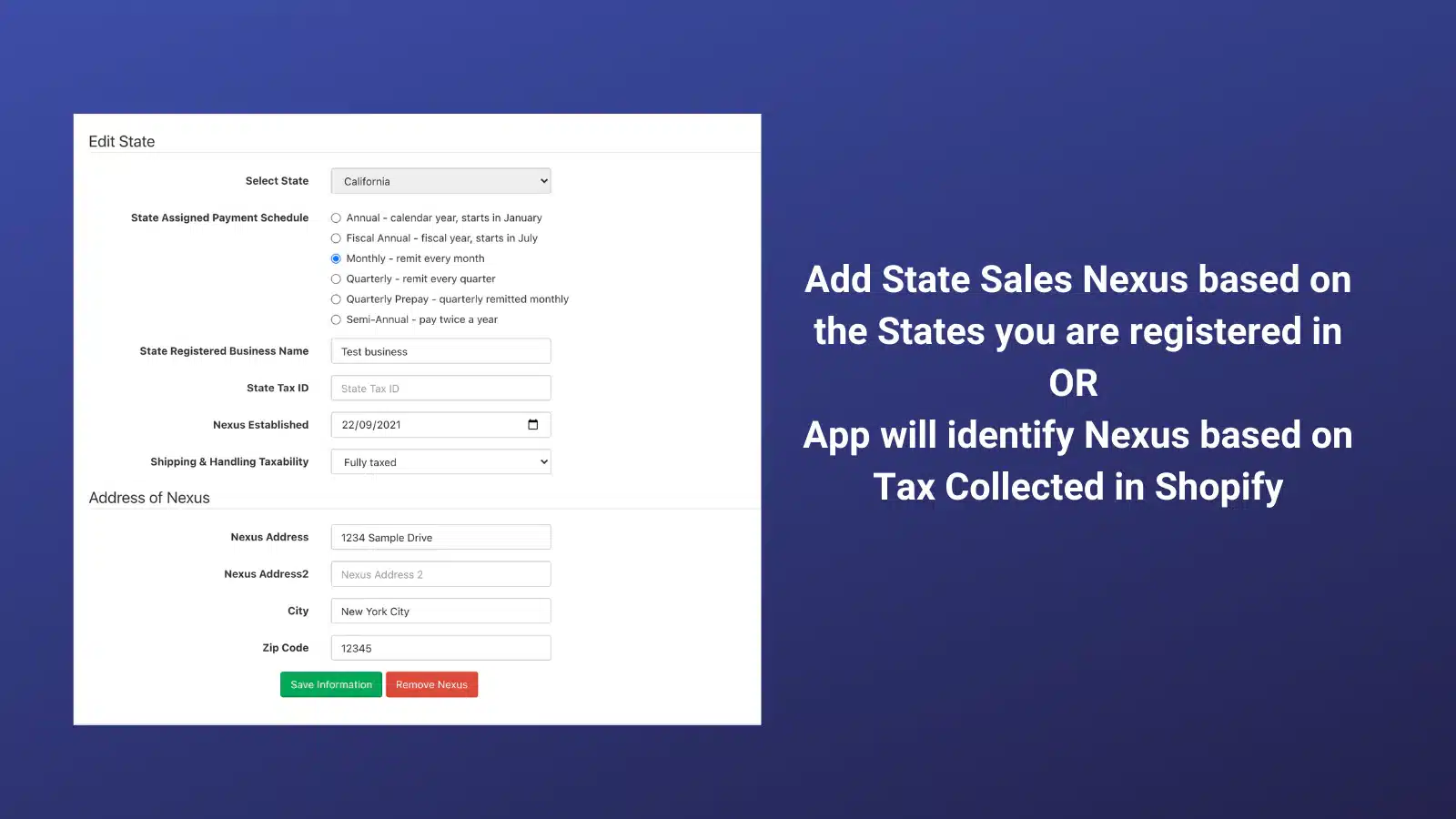

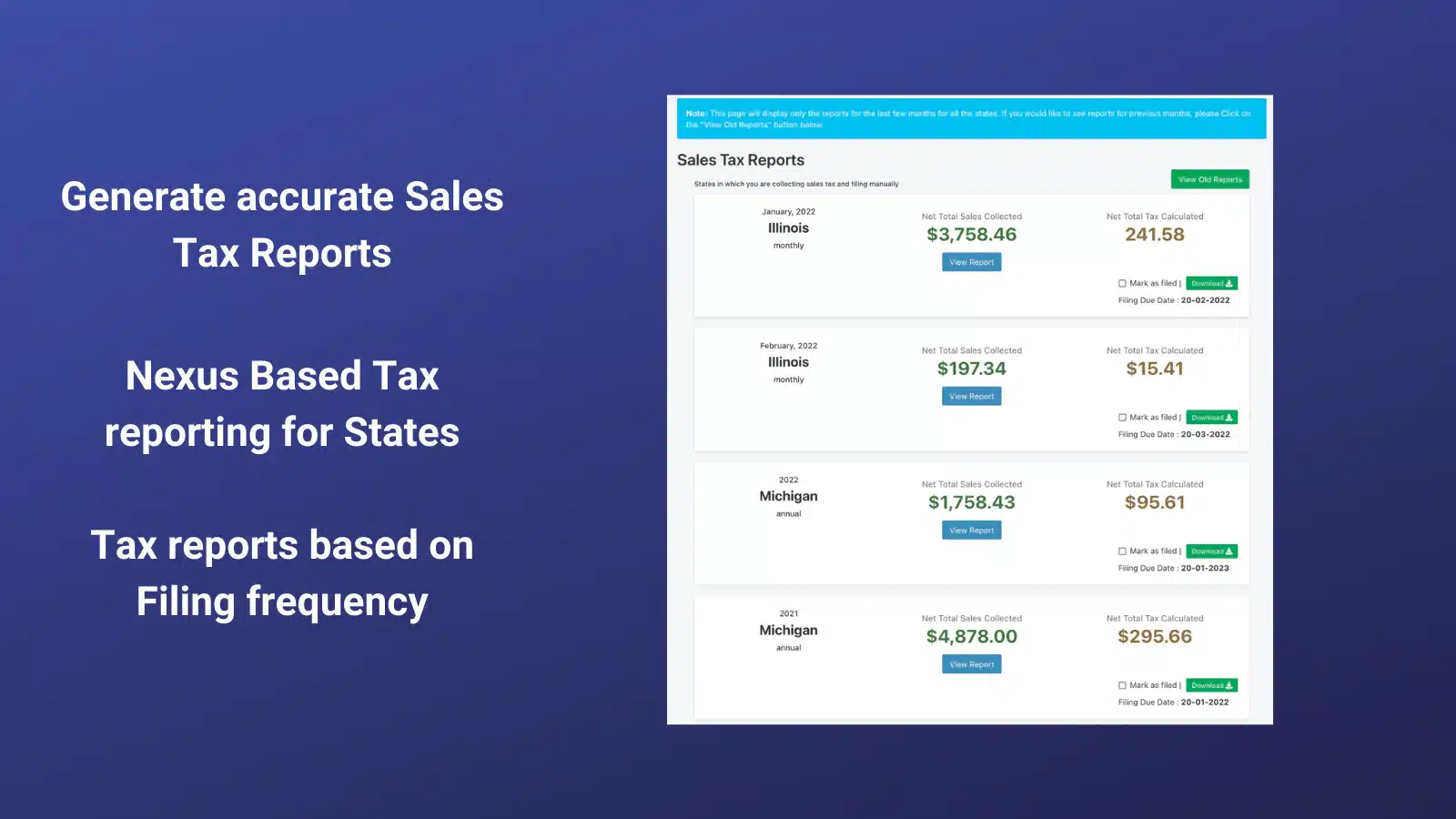

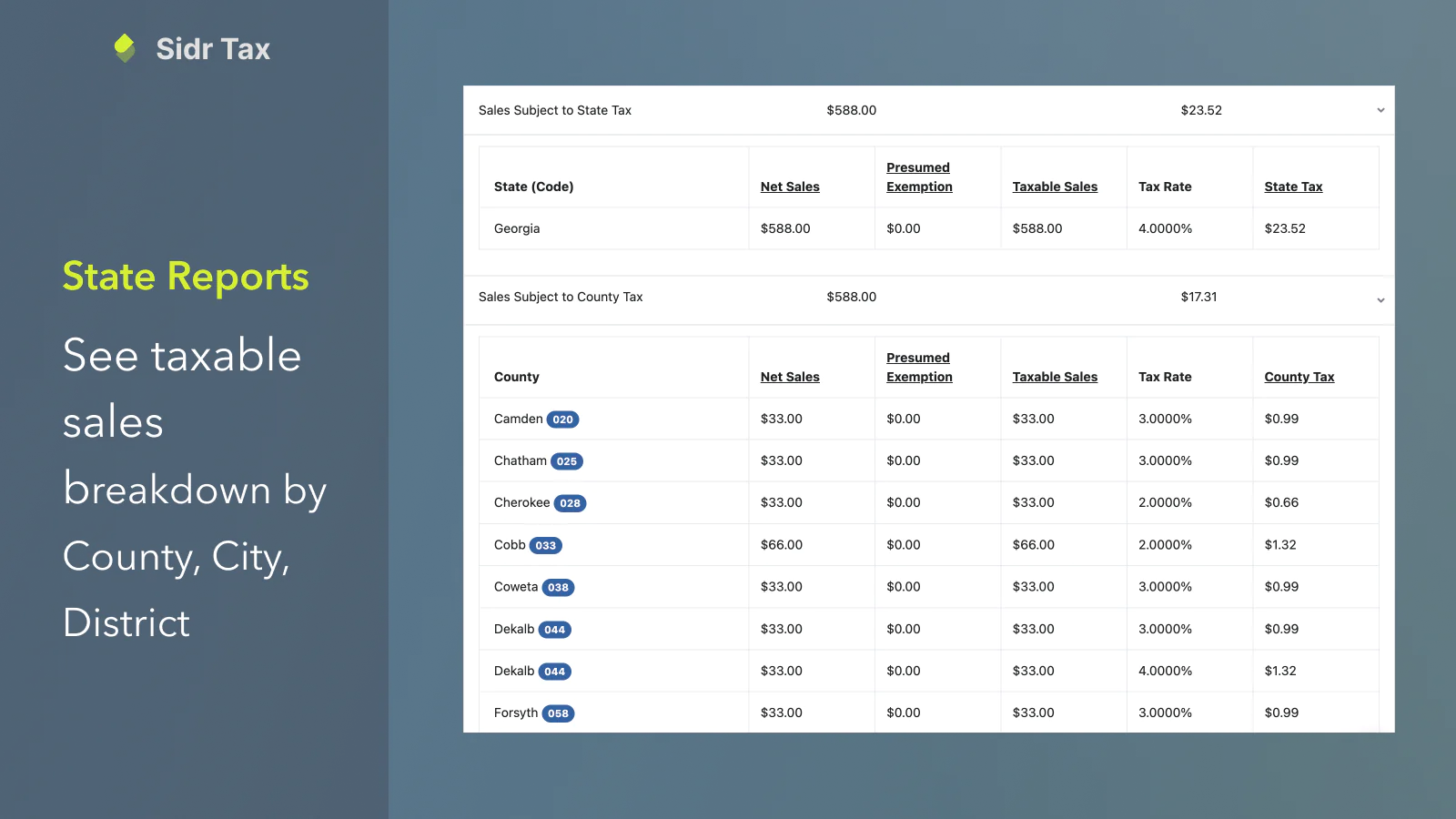

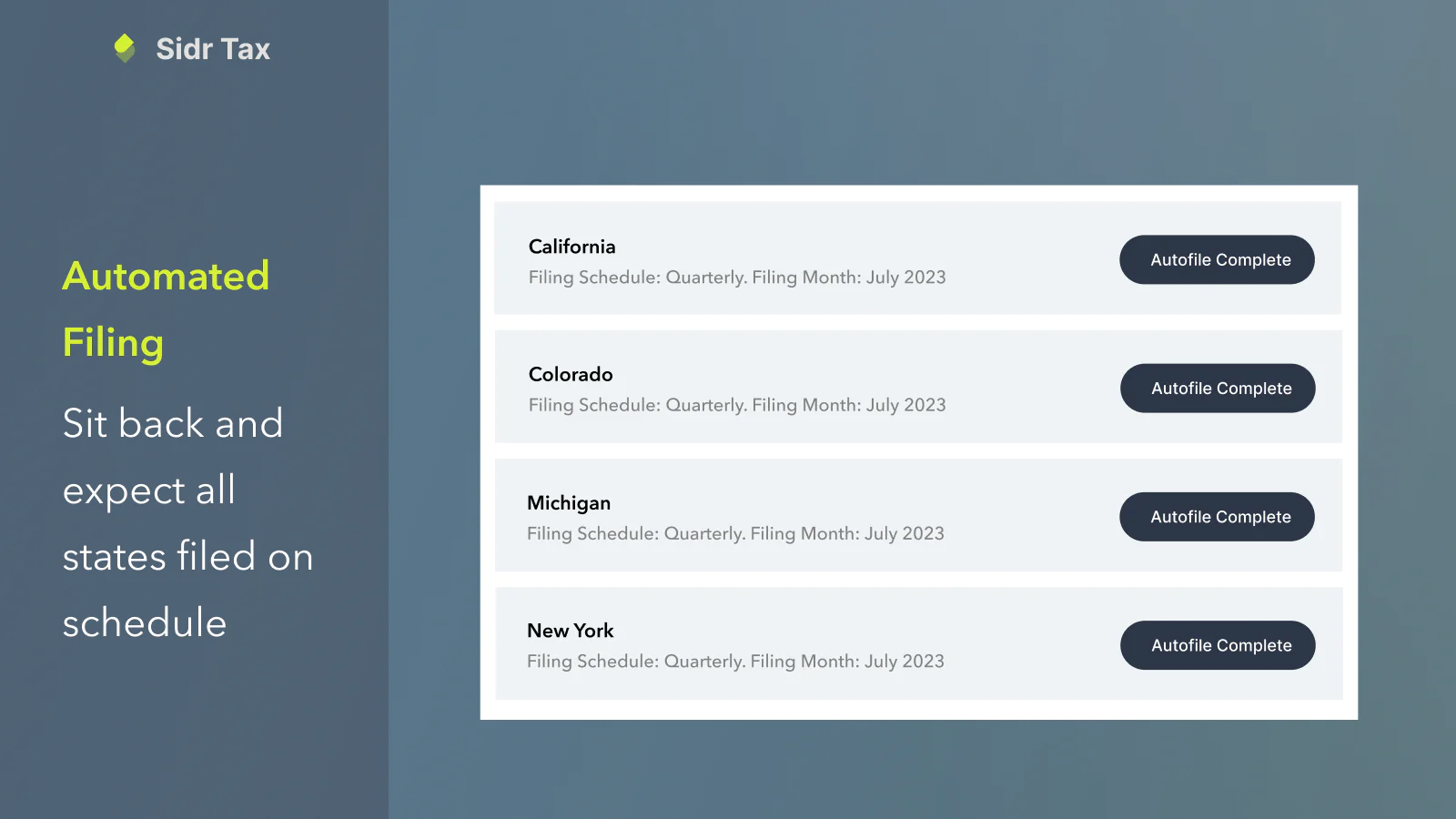

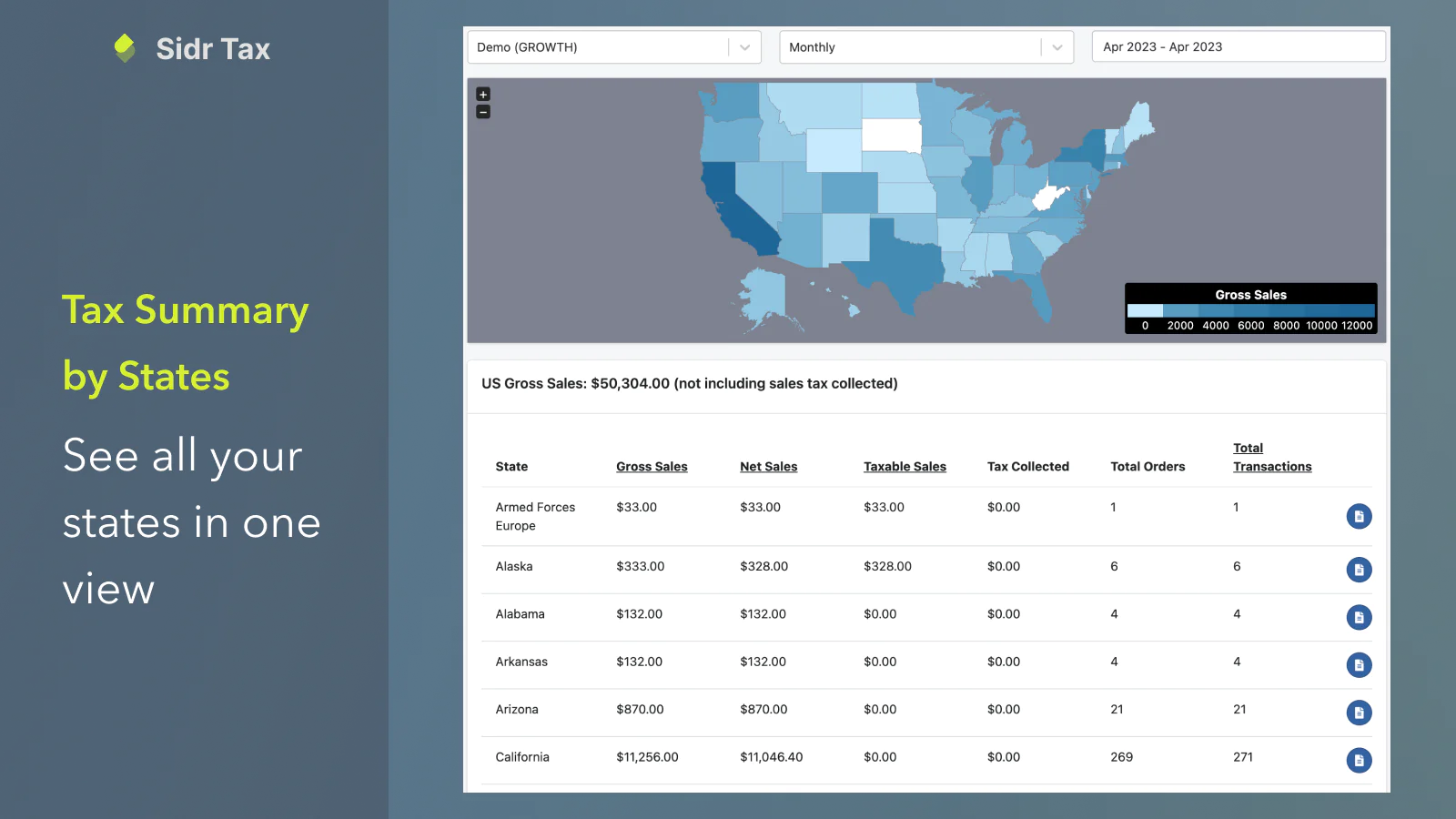

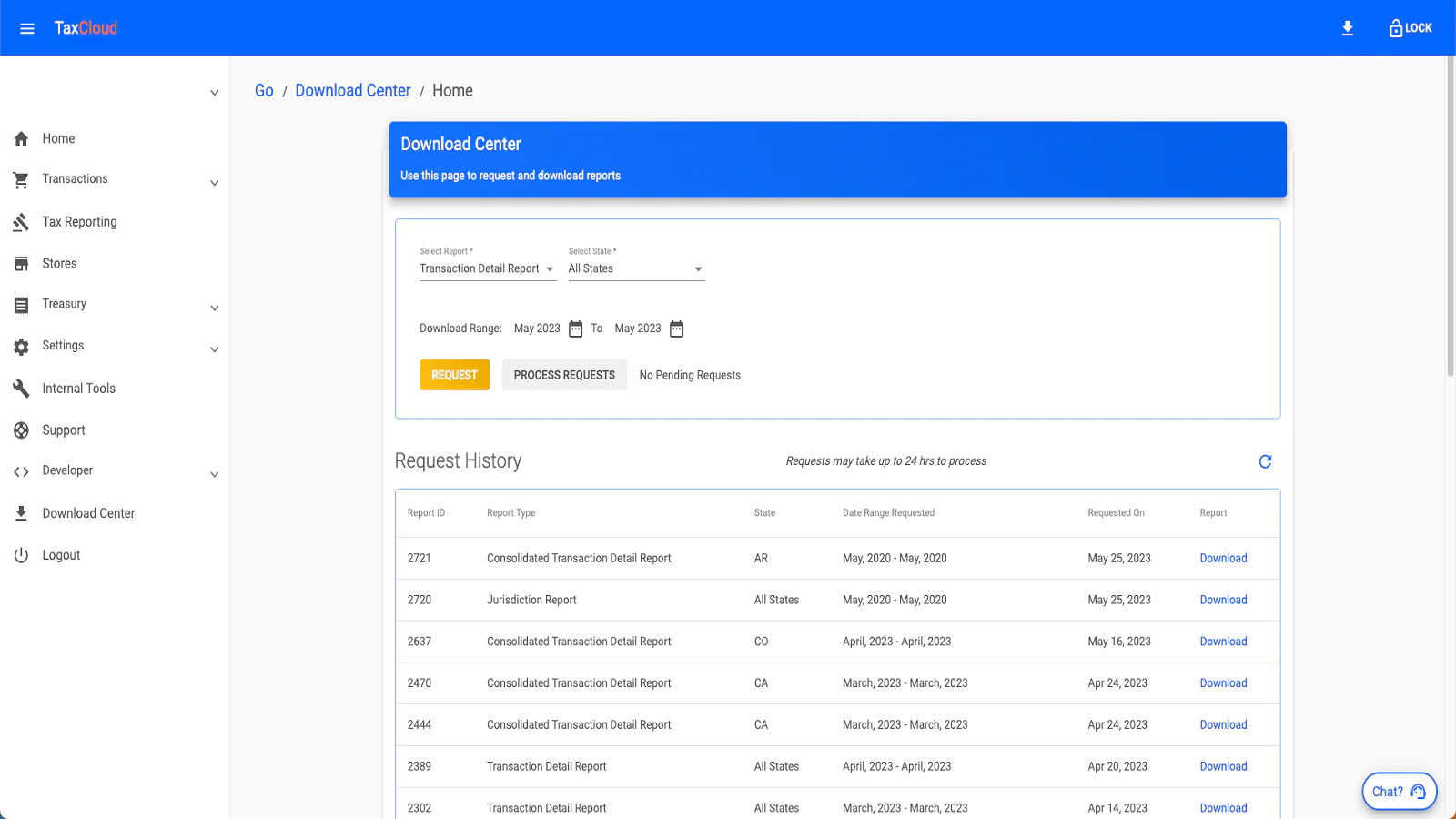

One of the standout features of these apps is their ability to automatically calculate sales tax based on the buyer’s location, the seller’s nexus, and the type of product sold, ensuring that customers are always charged the correct amount. Furthermore, these apps facilitate detailed tax reporting, summarizing the sales tax collected over specific periods and supporting electronic tax filings directly with tax authorities. This feature is particularly beneficial for businesses that operate across multiple jurisdictions, as it simplifies the process of staying compliant with varying tax laws.

Shopify Tax apps also offer real-time data synchronization, ensuring that tax calculations are always based on the latest sales data. Many integrate seamlessly with popular accounting software, allowing for an efficient transfer of financial information and streamlining the overall financial management process. Moreover, the apps provide customization options, enabling businesses to adjust tax rates for specific products or exempt certain customers from tax, catering to unique business needs.

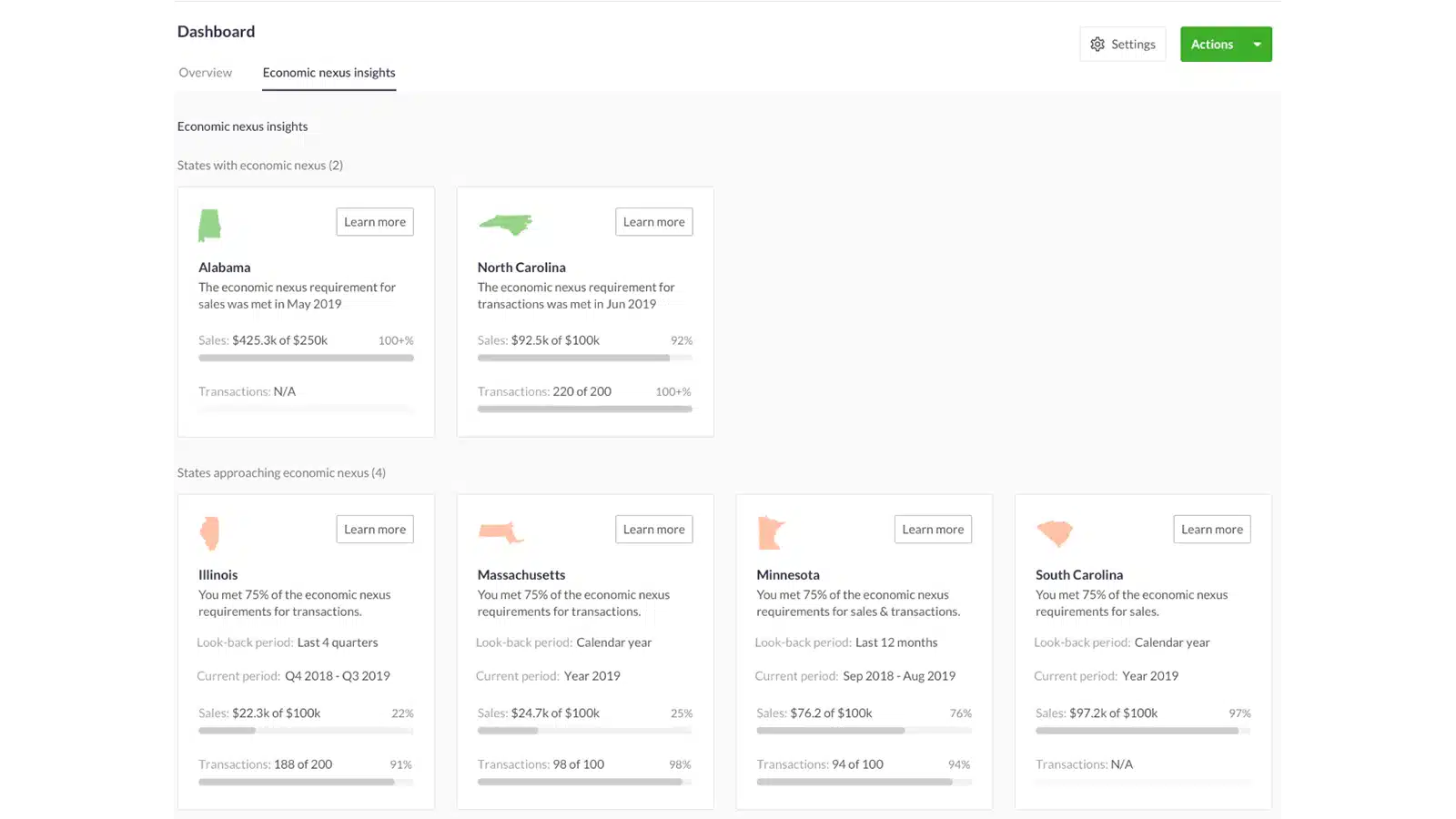

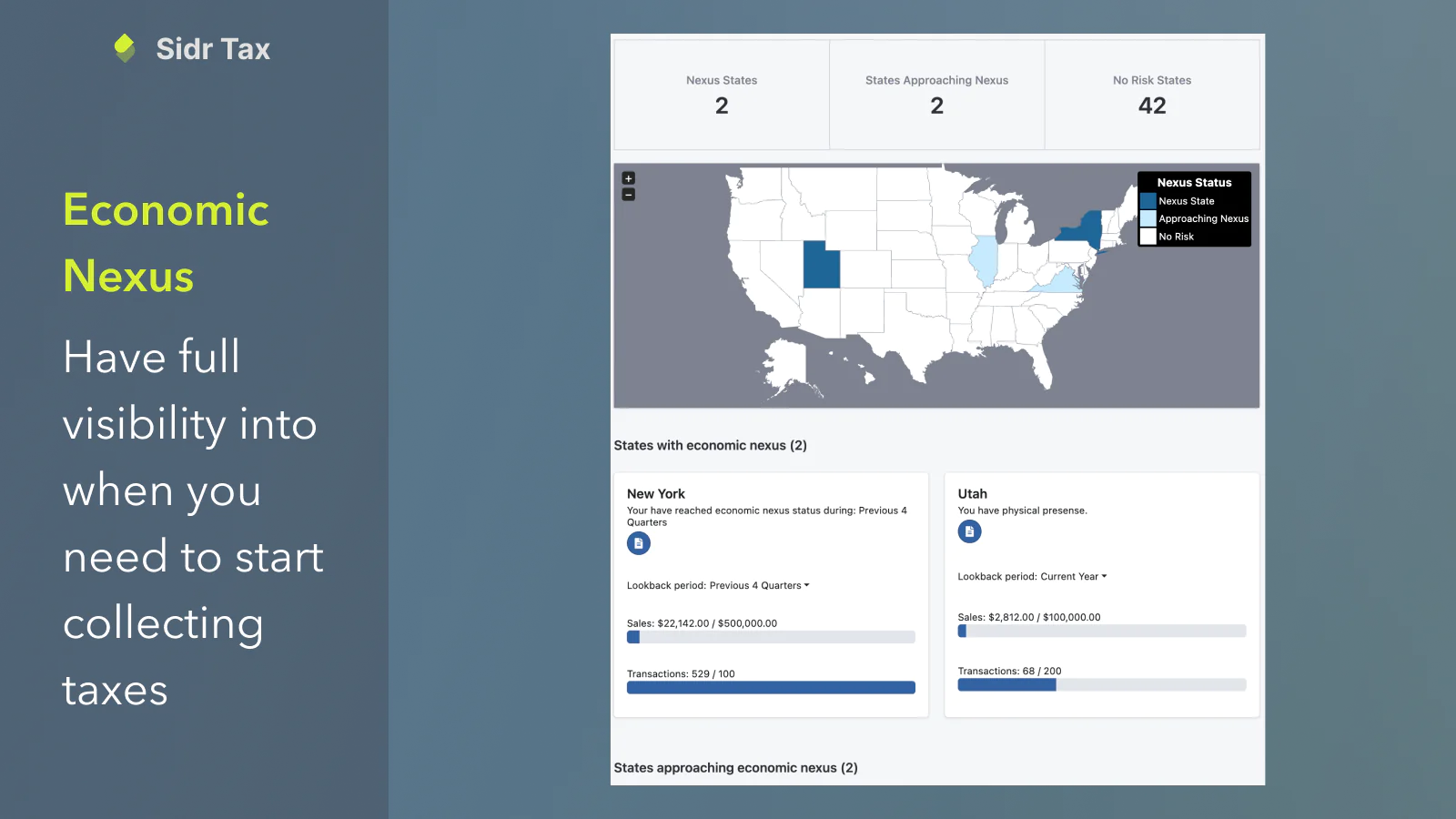

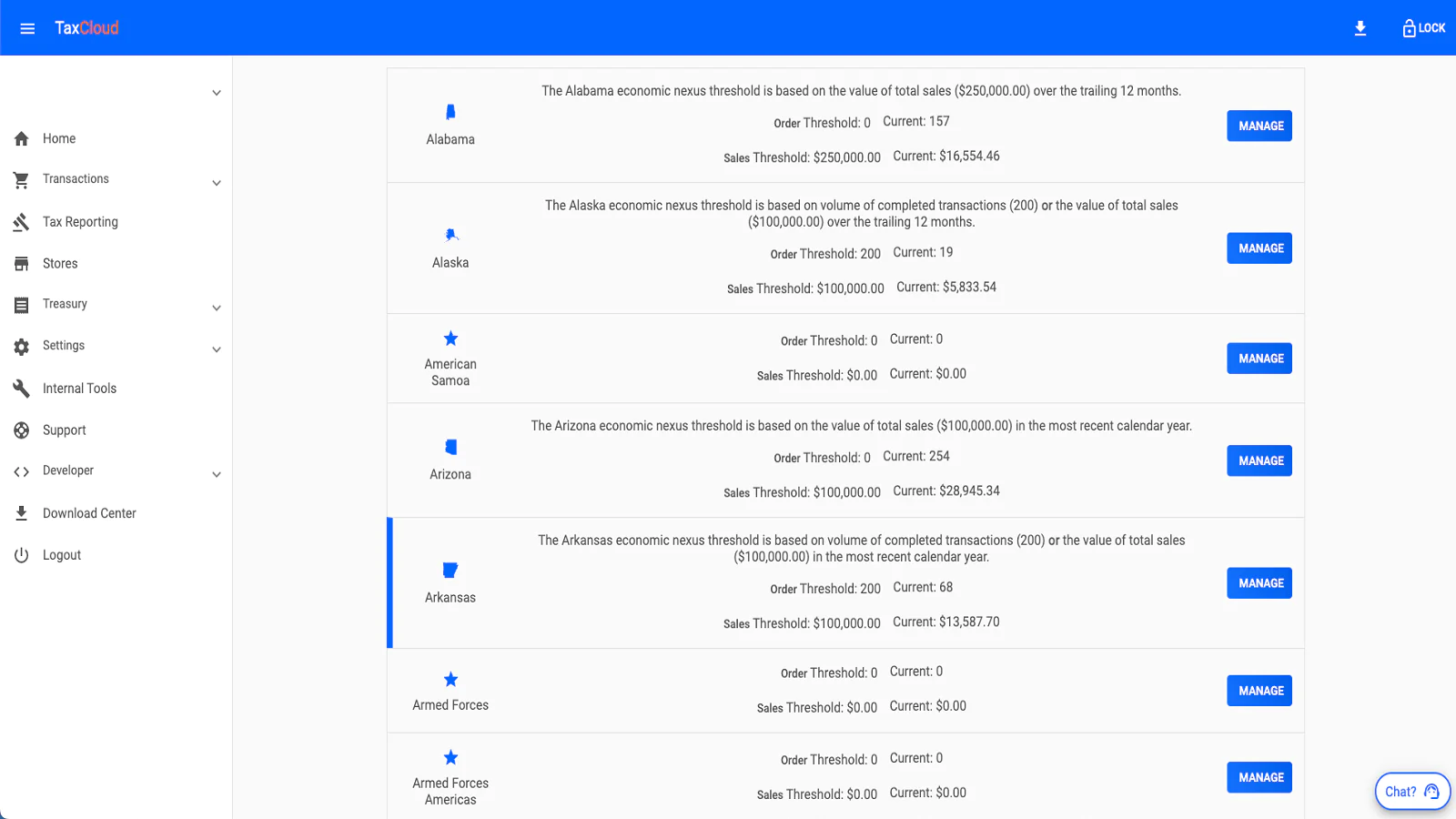

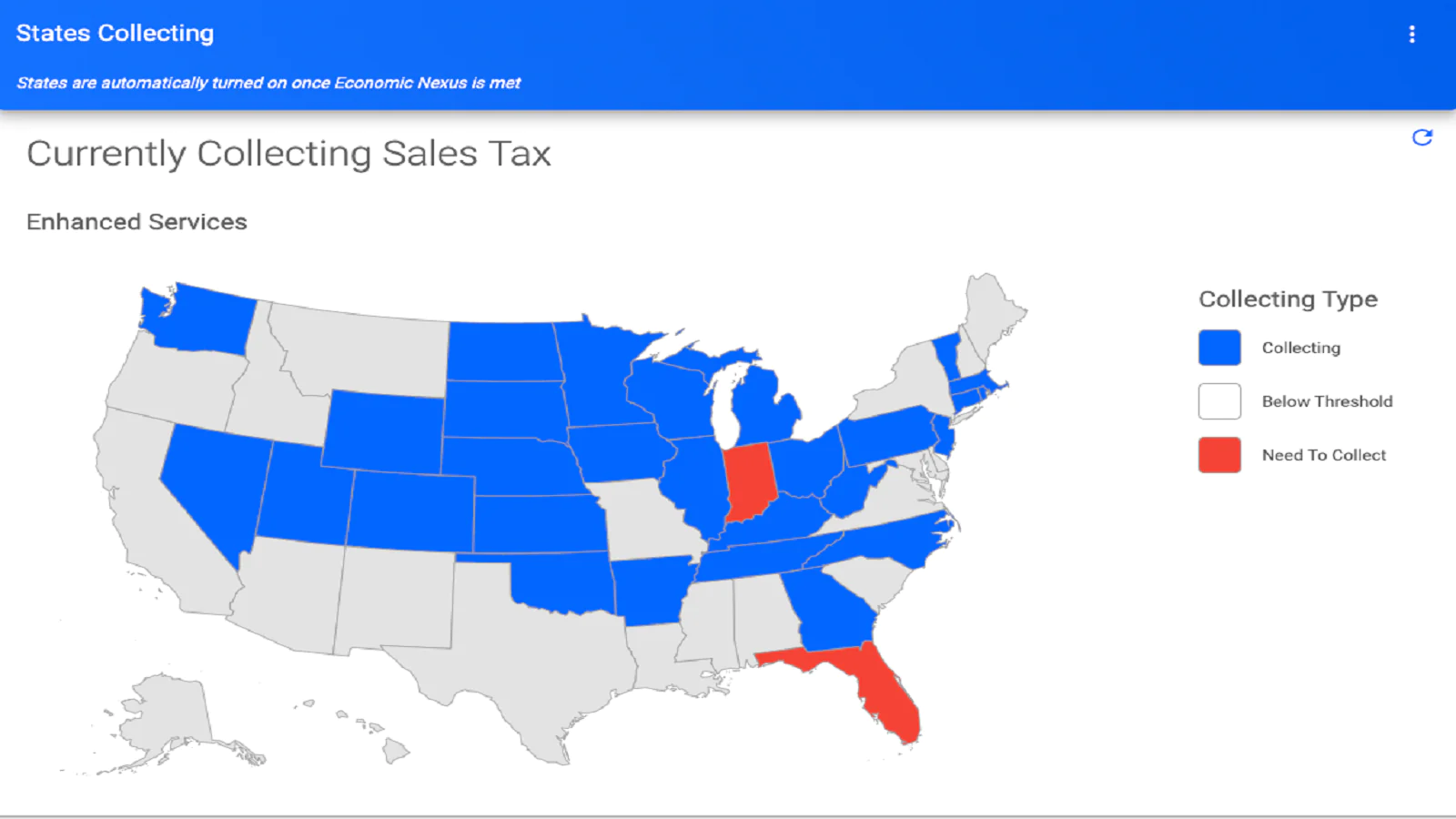

For businesses concerned about economic nexus, some Shopify Tax apps include features to detect when sales thresholds have been reached, triggering the need to collect sales tax in new jurisdictions. This capability is crucial for businesses looking to expand their operations while remaining compliant with evolving tax laws.

In essence, Shopify Tax apps significantly lighten the load of tax management for e-commerce businesses. By automating complex tax calculations and compliance tasks, these apps allow business owners to concentrate on growth and development, secure in the knowledge that their tax obligations are being expertly managed.

How do I set up local taxes on Shopify?

To set up local taxes on Shopify, you need to first determine your tax obligations and register with your region’s tax authority if necessary. After registration, go to your Shopify admin, navigate to Settings > Taxes and duties, and select your country or region to set up tax collection. Enter your tax number, and click “Collect tax” to start collecting sales tax in your registered regions. You can add more regions and update your tax settings as needed.

For a detailed guide on setting up local taxes in Shopify, including registering with tax authorities and entering your tax number in Shopify’s settings, refer to the Shopify Help Center. This resource provides step-by-step instructions tailored to merchants in various regions, ensuring accurate tax collection setup.

Does Shopify send you a tax form?

Shopify does not remit or file taxes for you but helps automate charging sales taxes. If using Shopify Payments and meet certain criteria, you may receive a 1099-K form, which is typically released by January 31st each year. You’ll be notified via email when it’s available for download. For detailed tax reporting information and obligations, consult the Shopify Help Center or a tax professional.

Conclusion: Best Shopify Tax Apps

It requires time and effort to compare and evaluate features of the various different Tax Shopify apps to find the ideal option.

Shopify store owners must evaluate relevant information to make the optimal choice for their needs.

This guide does the challenging work for merchants by comparing and evaluating the top choices for different Tax Shopify apps. The results of our analysis of the best Tax Shopify apps are listed below: