TaxJar Sales Tax Automation

TaxJar Sales Tax Automation revolutionizes the sales tax compliance process for Shopify store owners by automating crucial yet tedious tasks such as accurate sales tax rate calculation, product classification, and multi-state filing. Since its launch in August 2013, TaxJar has positioned itself as an indispensable tool for e-commerce businesses, delivering not only high performance but also reliability and scalability to accommodate business growth.

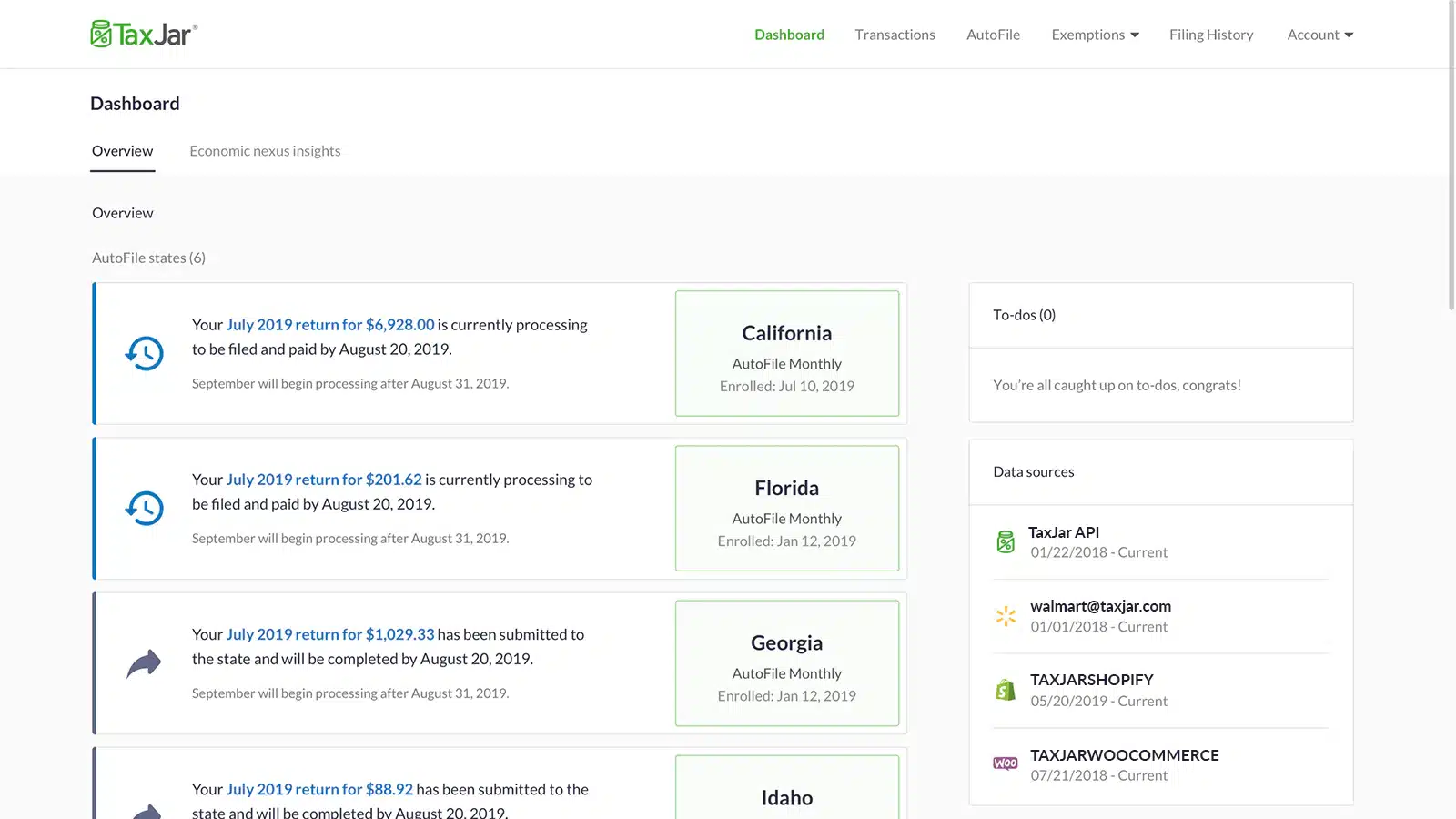

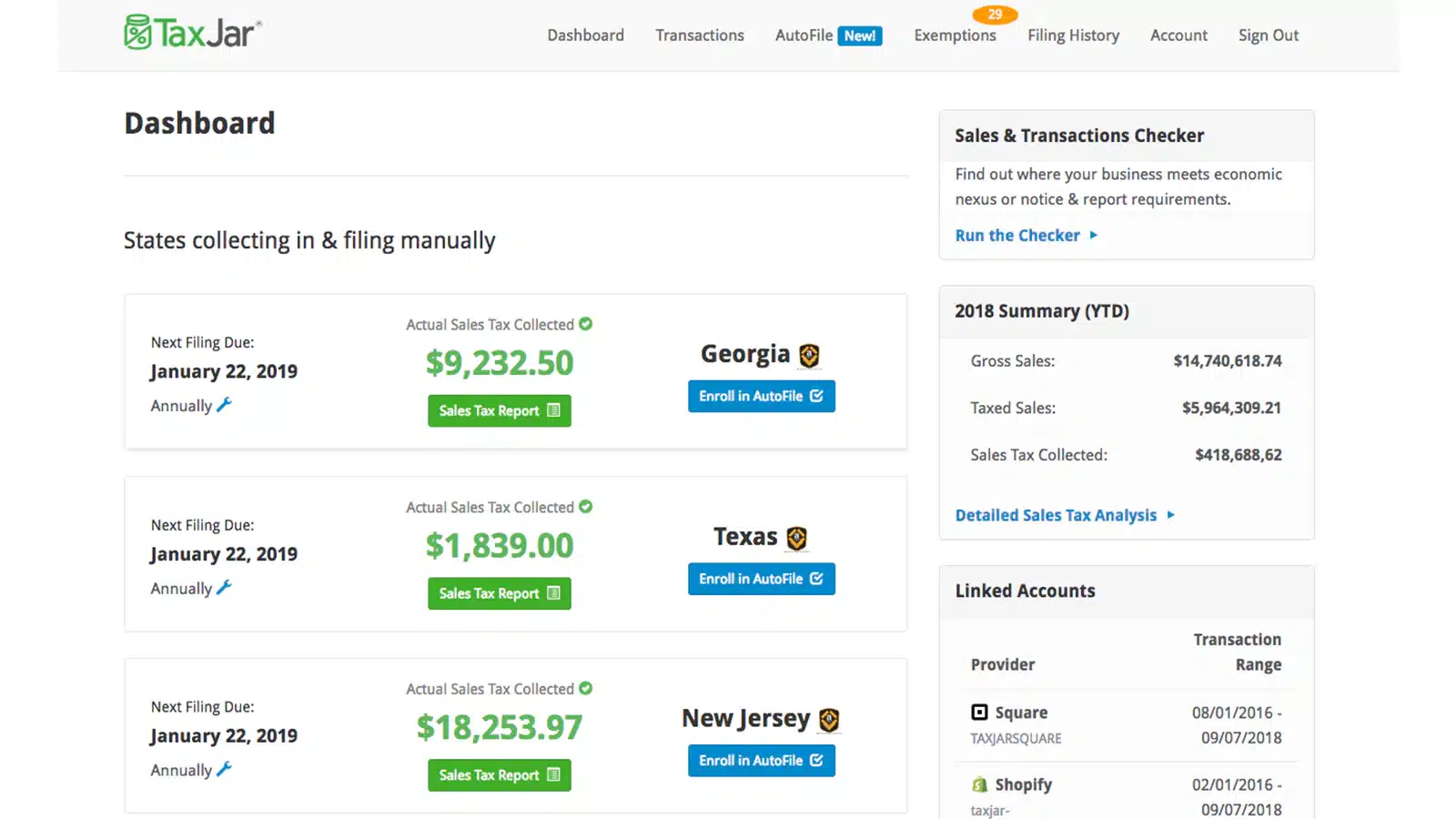

At the heart of TaxJar’s offerings is the AutoFile service, a standout feature that automatically submits sales tax filings on behalf of businesses for all US states. This feature liberates businesses from the manual submission process, ensuring they never miss a due date or file late returns, although it comes with an additional fee.

TaxJar caters to the needs of businesses selling across multiple channels by compiling sales data from various platforms into a single, accessible dashboard. This integration simplifies tax management for businesses operating on platforms like Shopify, Amazon, eBay, and more, making TaxJar an ideal solution for keeping sales tax management organized and straightforward.

The platform enhances the shopping experience on Shopify stores by ensuring that the correct sales tax rate is charged on every order. Thanks to TaxJar’s rooftop-level rate accuracy and AI tax categorization capabilities, businesses can stay compliant by charging the precise tax rates and automatically classifying product tax codes.

Additionally, TaxJar supports integrations with a wide range of e-commerce platforms and payment processors, further streamlining the sales tax management process across an entire business operation. This comprehensive integration capability ensures seamless management of sales tax obligations regardless of where the sales occur

While TaxJar provides a wealth of resources to help businesses understand their sales tax obligations, it’s important to note the additional cost associated with the AutoFiling feature and the software’s focus on serving US-based customers. Despite these considerations, TaxJar’s ease of use, coupled with its extensive educational tools and excellent customer service, makes it a valuable asset for businesses looking to navigate the complexities of sales tax compliance efficiently.

- Generous 30 day free trial

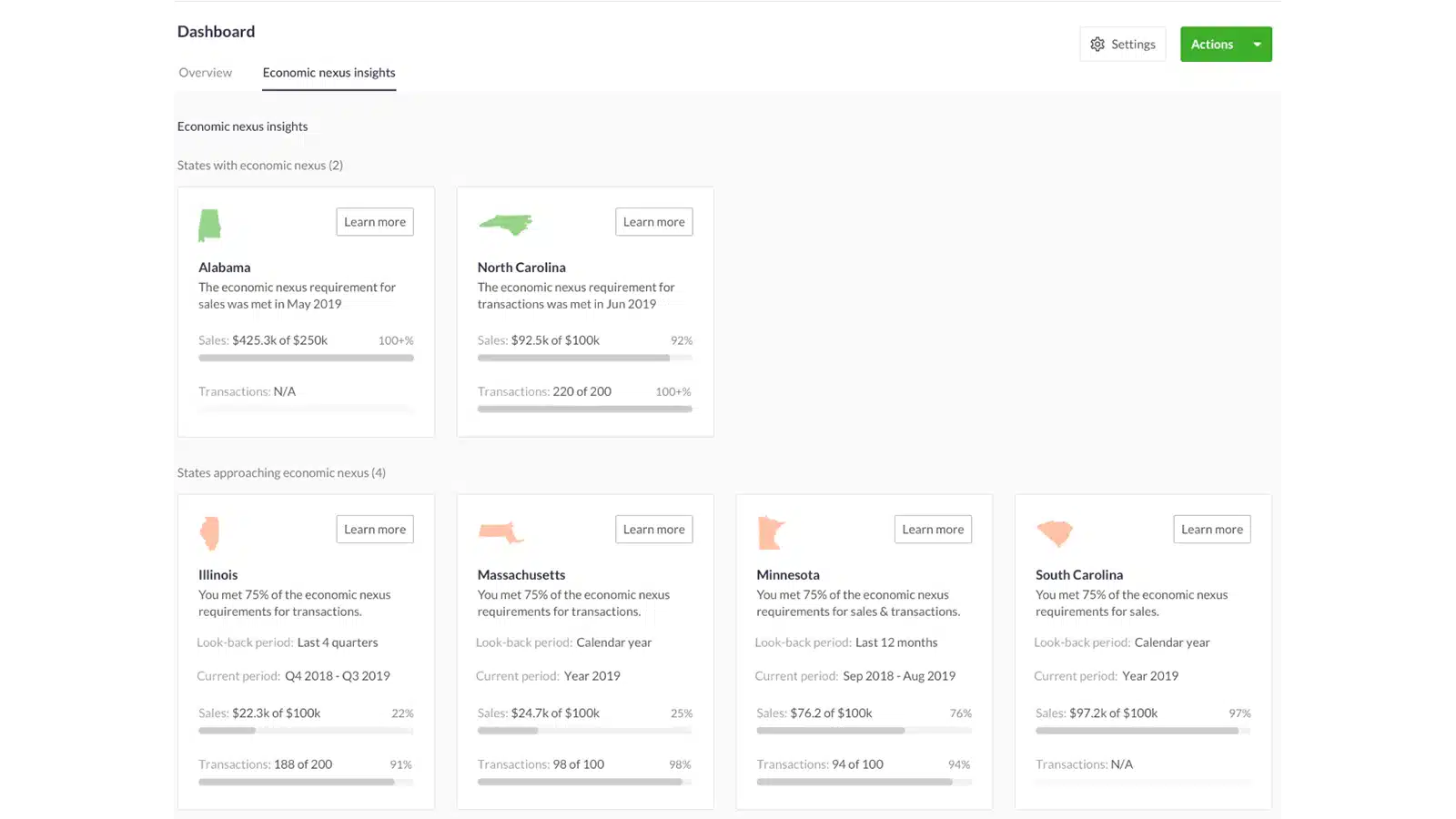

- Provides notifications when you are approaching sales tax thresholds in various states

- Enables businesses to register for state sales tax permits in states where they operate, streamlining the process of becoming tax compliant

- Ensures that the correct retail sales tax rate is charged on every order on your website, maintaining accuracy in tax collection

- Supports integrations with well-known vendors like Amazon, Shopify, Netsuite, BigCommerce, Salesforce, enhancing its compatibility and functionality across various sales channels

- Boasts a 99.99% uptime guarantee, ensuring that your shopping cart never slows down due to tax calculations

- Offers a sub-18ms response time, which is faster than competitors, for quick and efficient tax rate determination

- Guarantees accuracy for rooftop-level rates, eliminating the need to fuss with rate tables for tax calculations

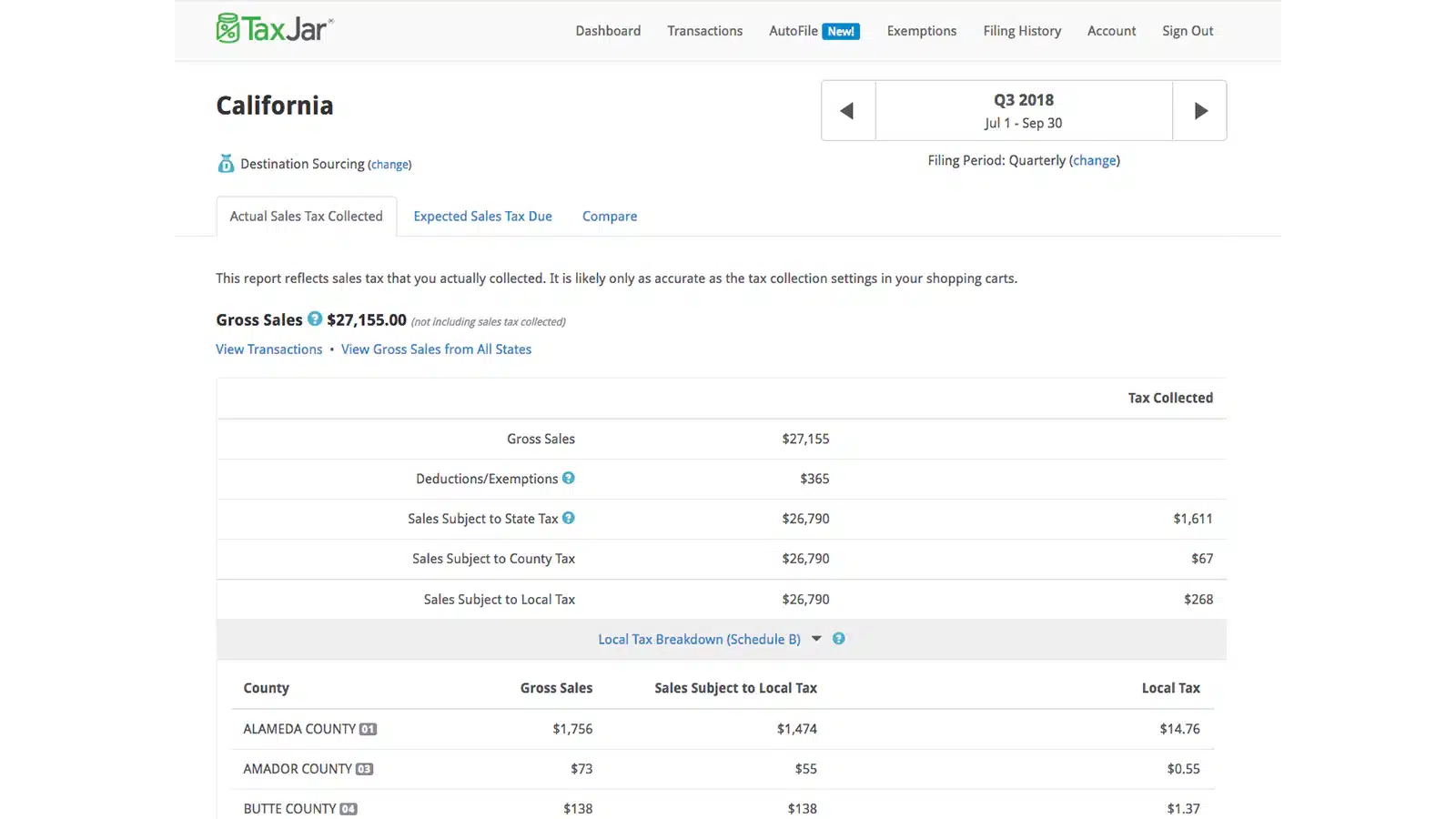

- The platform provides detailed and accurate reporting, showing sales and sales tax collected for each state and local jurisdiction

- TaxJar's data automatically updates daily, allowing you to see the collection in sales tax for any state you have nexus in and when your next payment is due

- The reporting feature includes estimated sales tax reports to verify if you’ve been collecting the correct sales tax amount

- Help desk comes complete with support for multiple matters regarding sales tax and filing, offering a wealth of information for almost any issue you might face

- No free plan available

- Limited phone support access, with some users expressing a preference for more direct contact options for resolving issues

Free Guide: How To Find A Profitable Product To Sell Online

Excited about starting a business, but not sure where to start? This free, comprehensive guide will teach you how to find great, newly trending products with high sales potential.