I thought I would outline the major differences between the two Shopify apps, so that entrepreneurs on Shopify can make an educated decision based on their requirements and plans for their store.

Here’s my breakdown of what separates Spocket from Oberlo, the best dropshippers for shopify, classified into the following categories:

- Product Sourcing: What products are available and where do they come from?

- Automations: How much of the business you can automate.

- Branding and Viability: How the app help in building your brand, and if you can place your trust in it.

- Product Deliveries: How long the products take to reach your customer.

- Support: How efficient support is when you require assistance.

- Pricing: Is the app worth the money?

Let’s dig deeper into this Spocket Shopify review and review of Shopify dropshipping app Oberlo.

Product Sourcing

Oberlo is a Shopify dropshipping app that primarily focuses on products from AliExpress, with a few suppliers that are verified. While this allows for an enormous library of products available to add to your store, the problem that plagues all AliExpress based stores follows one here as well.

Choosing a reliable, trustworthy supplier out of the many available is quite difficult, but if you do manage to find a great product, the low product costs can bring in a number of impulse sales. Quite a few unique products are available as well if one delves deep.

The Oberlo extension, which allows you to add the product directly to your store from AliExpress does make the task easy, but the shipping times and quality are difficult to trust entirely.

Spocket shopify review

The average product quality on Spocket seems to be better- owing to the products being sourced from individually vetted suppliers from around the world. Spocket focuses on local manufacturers, Etsy artisans and distributors rather than AliExpress for the products listed.

The supplier team of Spocket personally goes over a strict procedure for onboarding suppliers with interviews and sampling being a part of the process, which explains the better pictures and products.

Additionally, a huge chunk of Spocket suppliers are based in the US and EU, which might contribute to faster shipping.

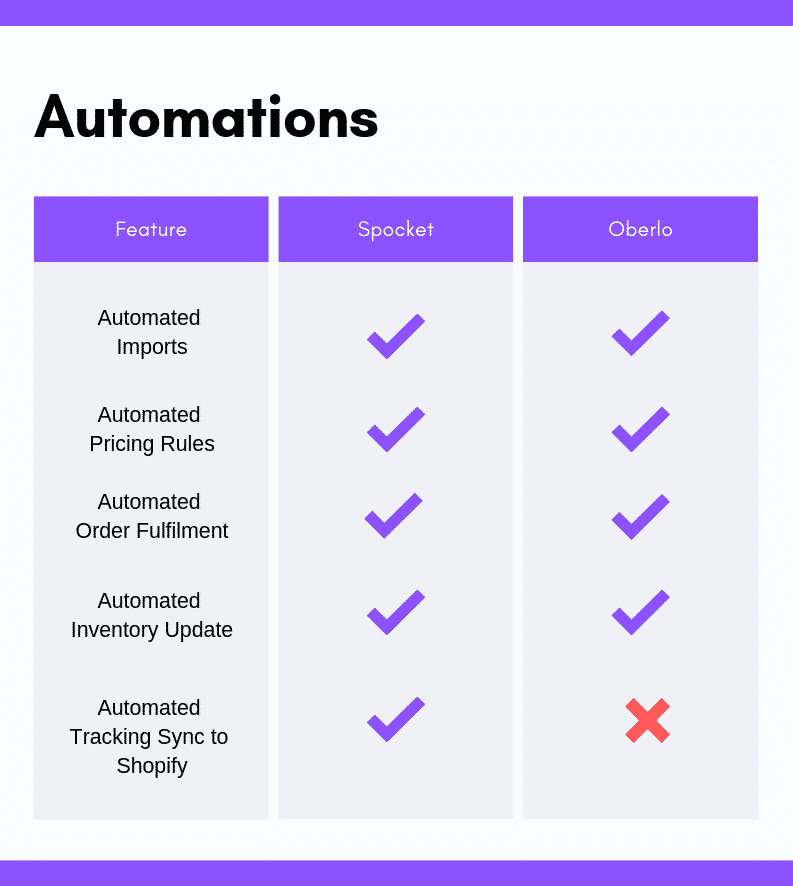

Automations

In terms of automations, Spocket and Oberlo mostly allow for the same facilities, which are essential to any dropshipping business. This is not a tie-breaker for either of the apps.

Branding and Viability

As a brand in a crowded marketplace, you need to stand out by cultivating exceptional relationships with your customers.

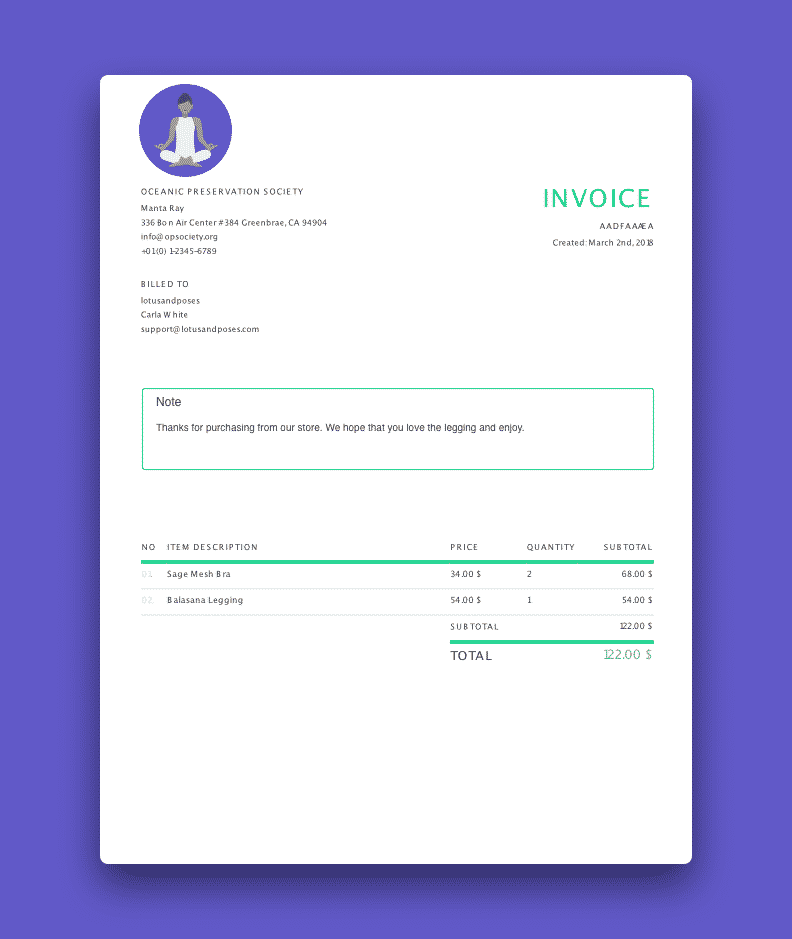

Both Spocket and Oberlo guarantee that none of the suppliers will add any promotional material, invoices or flyers with the packages that reach your customers.

With Spocket, you get an additional benefit that Oberlo does not provide: along with neutral, generic packaging, suppliers will also attach your store’s invoice to the box- with your store’s name, contact details, your logo and a personal note from you to the customer.

Spocket offers the ability to order samples from the search page and special collections that make it simple to import new products: new features often pop up on the app to help businesses.

Oberlo is an older company, founded in 2015- Spocket is relatively new, just over a year old.

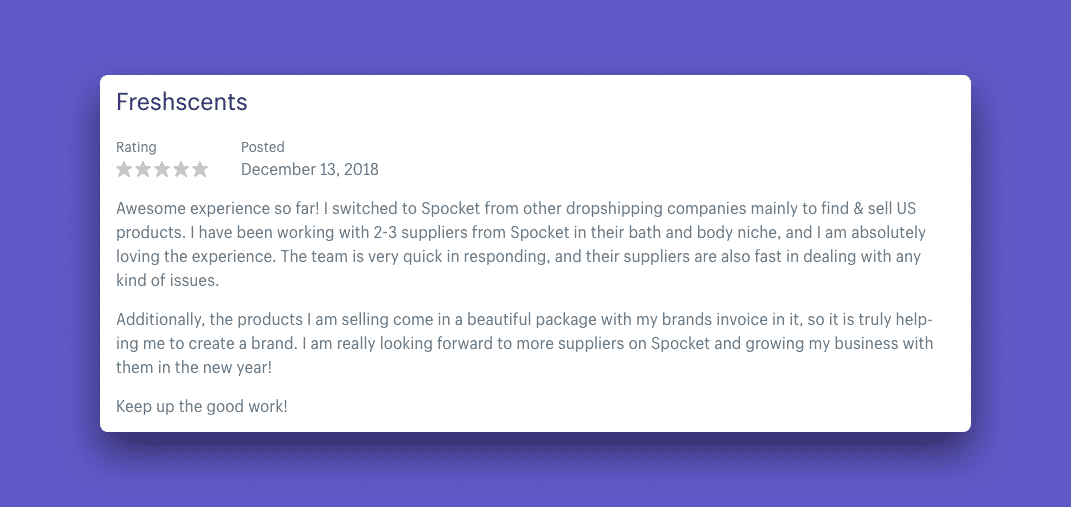

Spocket is rated 4.8 on Shopify, with over 1000 reviews, and more than 20,000 retailers are using the app to scale their businesses.

Oberlo, on the other hand, is rated 4.7, with 2000 reviews: owing to the longer period they have been active.

Product Deliveries

The most common complaint heard about Oberlo products, is the extensive delivery times. With products shipping from abroad, this is a side-effect that cannot be avoided. However, with the age of instant gratification, faster deliveries are a requirement rather than a convenience.

Spocket deliveries are generally faster: their entire USP being the specially selected US/EU suppliers. While the Spocket catalogue is not as vast as Oberlo’s, the products are not found everywhere and ship quicker.

Support

Spocket and Oberlo both have 24/7 customer support, with in-app chat facilities, so that no matter what problem you incur, you receive assistance.

I did find a number of reviews on the Shopify app store praising the support people received from Spocket.

Beyond that, both apps have a well-stocked self-help centre, where you can go through all the frequently asked questions and step-by-step explanations of all processes.

Additionally, Spocket’s Facebook group is quite a helpful community where tips, tricks and educational material is posted regularly, and retailers can have their sites reviewed by experts for free.

The Spocket Blog and the Oberlo blog both post useful content multiple times per week, which provide quite some value to new entrepreneurs.

Pricing

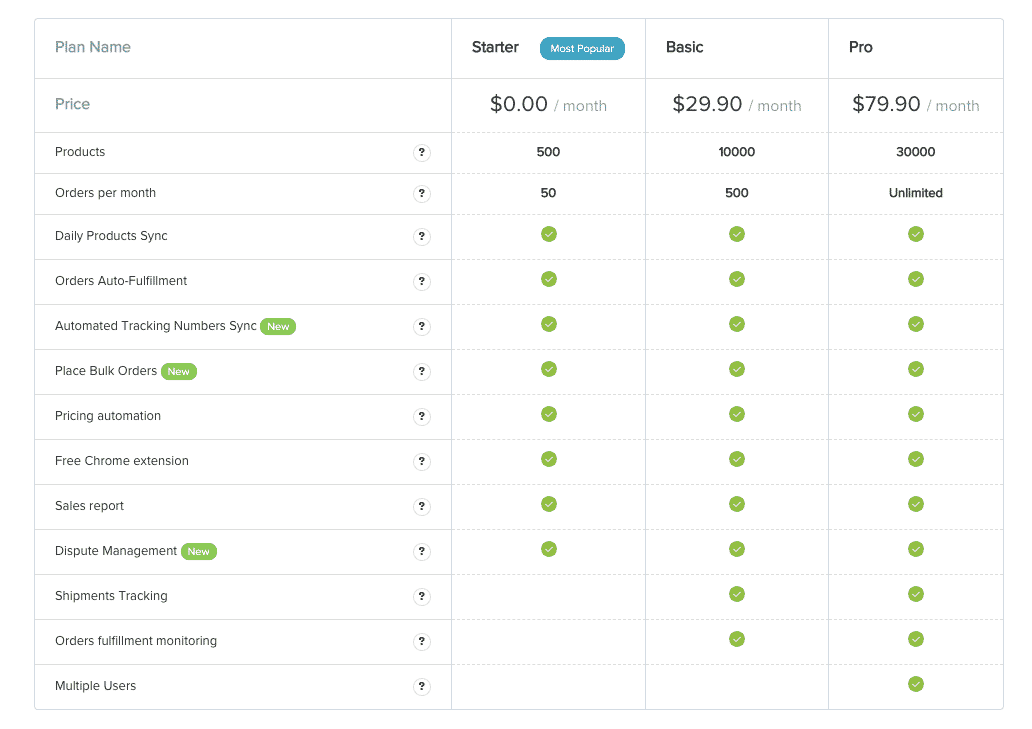

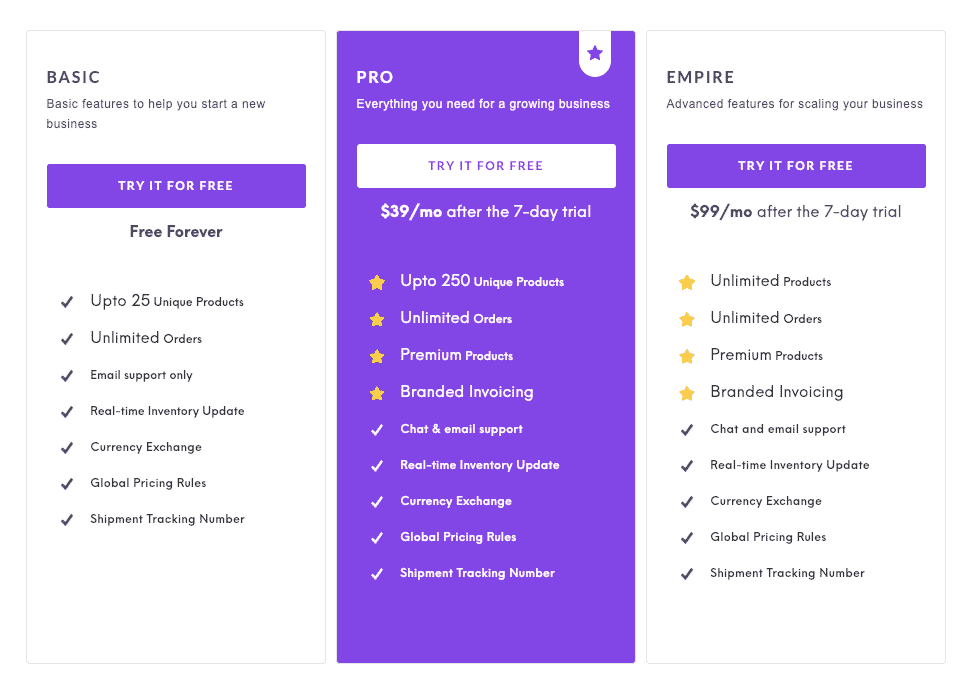

Here is where things truly diverge: Spocket has three plans, with the basic one being entirely free, the Professional Plan costing $39 and the Empire Plan costing $99.

Oberlo, on the other hand, has three plans ranging from free to $79. Though this sounds great, there is one obvious flaw.

While Oberlo does allow 500 products to be imported on the free plan, you are allowed only 50 orders: which boils down to one to two orders per day. Now these 50 orders need not be for Oberlo products to deserve a charge of $29.90. If you have 50 orders on your store, you are required to opt for the higher plan.

What is surprising is that you do not need 500 products to start your store, or have a successful store. Having tons of cheap products are not what bring a store sales. A cap on the number of orders you can make with a plan is quite constricting, on the other hand.

Spocket allows order tracking to all users, which I believe is important for customer satisfaction. Spocket also automatically syncs the tracking number to Shopify, while with Oberlo, you have to manually enter them through Oberlo to the Shopify interface.

One thing that Oberlo offers on its Pro Plan that Spocket does offer is multiple user accounts. The rest of the features are similar across the two apps.

One thing I like about Spocket is that it has a 7-day free trial that allows retailers to test out the monthly plans before they commit to it.

Best dropshipping apps comparison

While both Spocket and Oberlo both hold formidable positions on the Shopify app store, Spocket has quickly covered ground that Oberlo left bare. Oberlo can be used for impulse buy products and a quick buck. Our Spocket dropship review clearly has a winner.

For sustainable business development, Spocket has targeted all the pain points that retailers faced when operating a dropshipping business on Shopify, and has created an experience that is easy, smooth and user-friendly.

Most Shopify store designs will be based on one of the large range of eye-catching templates provided by the platform. There are free templates and paid-for options and you can customize them.

Most Shopify store designs will be based on one of the large range of eye-catching templates provided by the platform. There are free templates and paid-for options and you can customize them.