Top 5 Shopify Payment Apps [July, 2024]

This guide helps ecommerce store owners to compare and find the best Payment apps for Shopify. Payment apps are popular for ecommerce businesses that want to offer customized payment processing services to Shopify store owners. However, with the variety of Shopify apps for Payment, it can be challenging to find the ideal app for store owners’ individual needs.

To help ecommerce store owners make the right choice, the attributes of available Shopify apps have been assessed considering: features, price, free trial availability, app store rating and free app options.

This guide compares five companies for merchants to review and find the optimal Payment app for their needs. To help them make an informed decision, a quick comparison table of the best Payment Shopify apps is shared below, followed by in-depth reviews and frequently asked questions.

Free Guide: How To Find A Profitable Product To Sell Online

Excited about starting a business, but not sure where to start? This free, comprehensive guide will teach you how to find great, newly trending products with high sales potential.

Quick comparison of the best Shopify Payment apps

| # | App Name | Developer Name | Pricing | Rating | Free Trial | Image | Action |

|---|---|---|---|---|---|---|---|

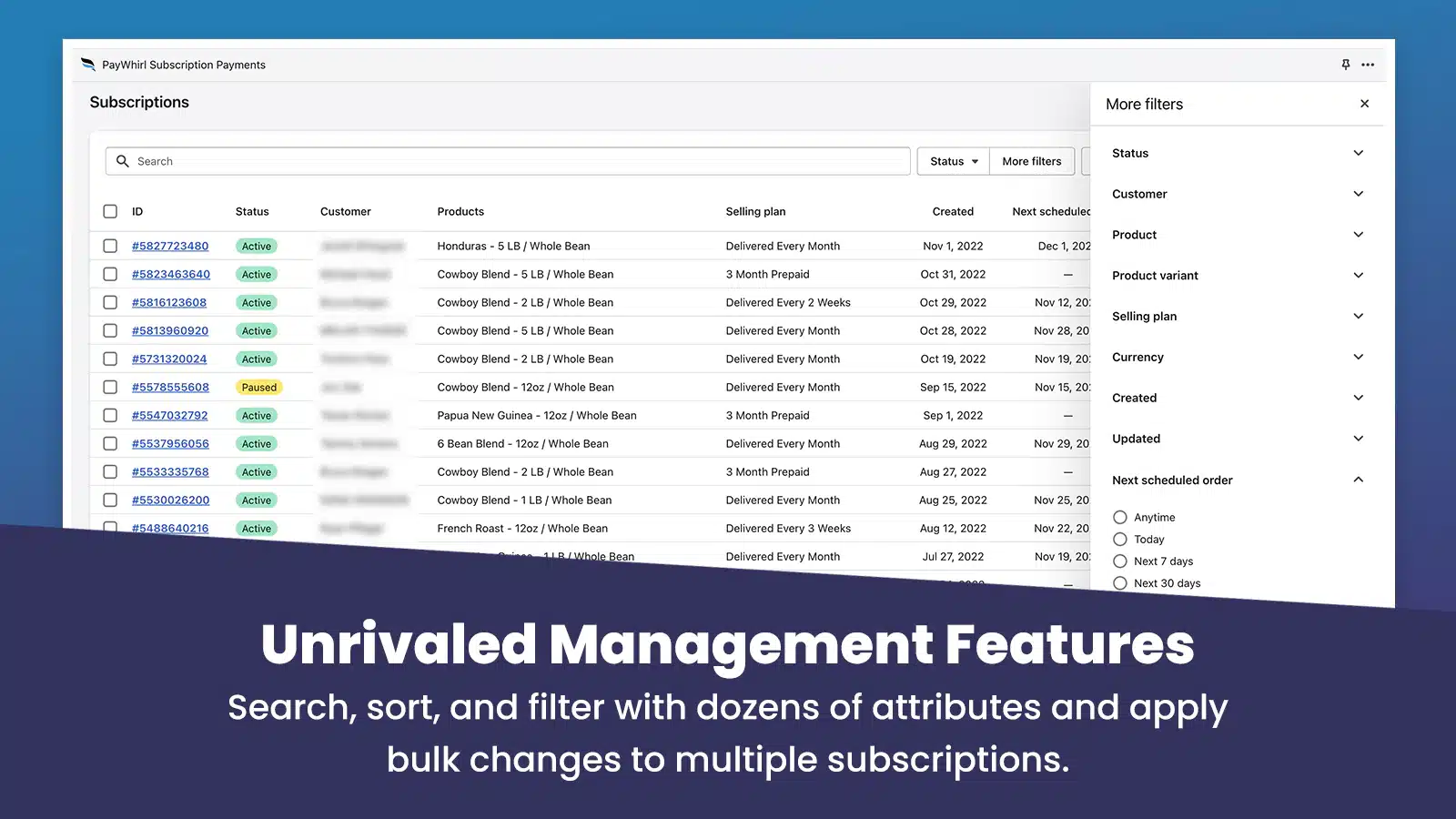

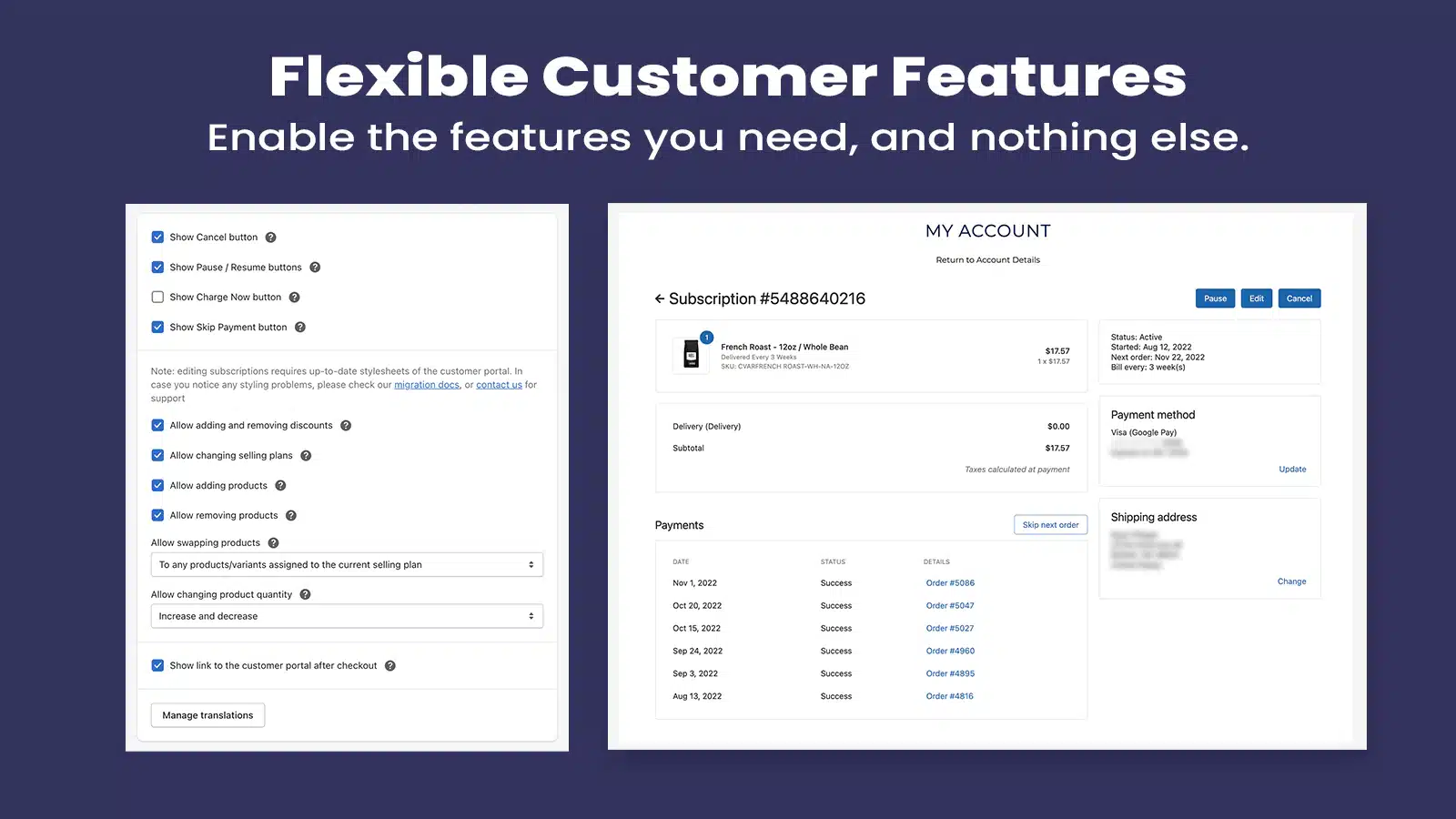

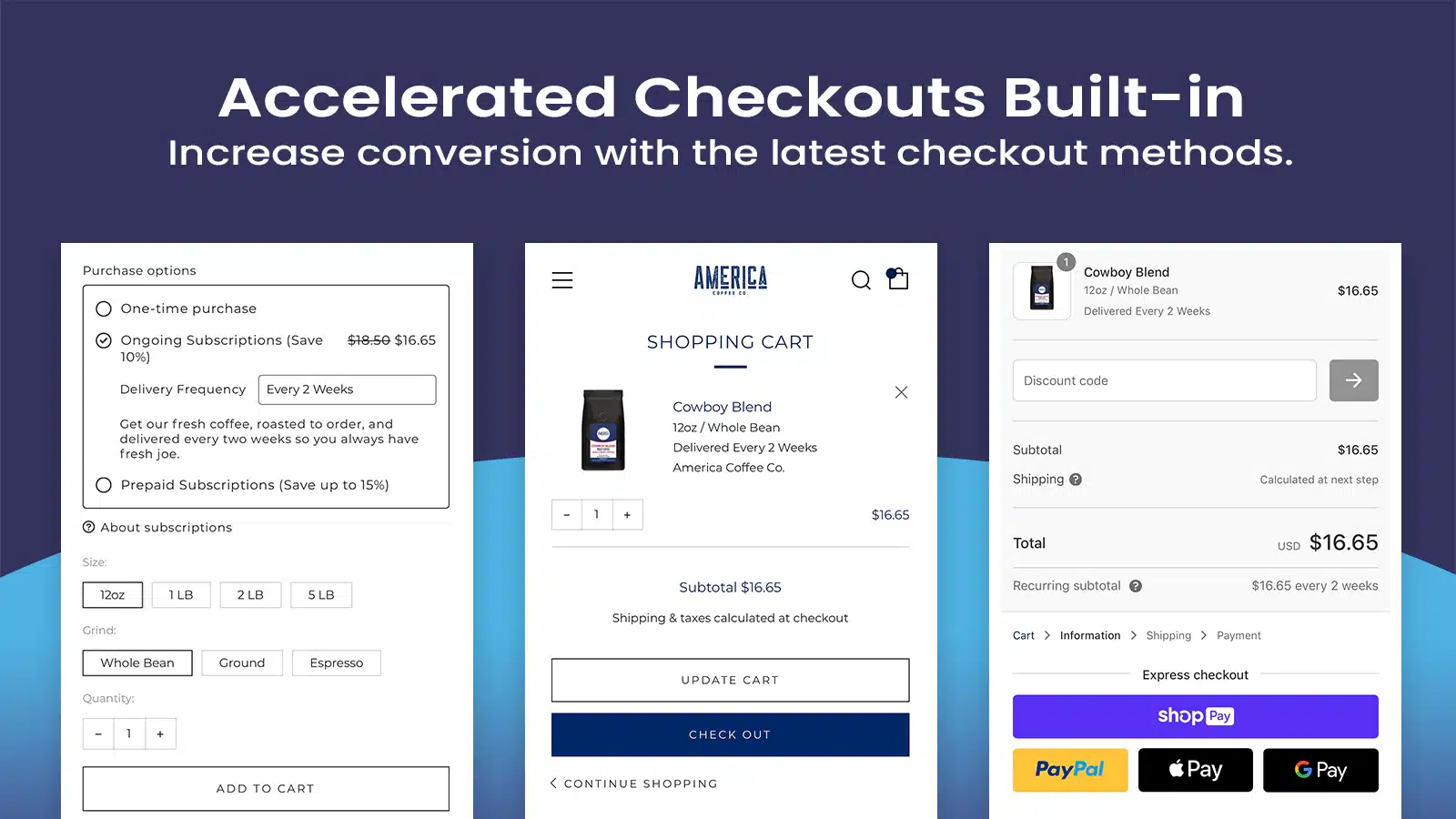

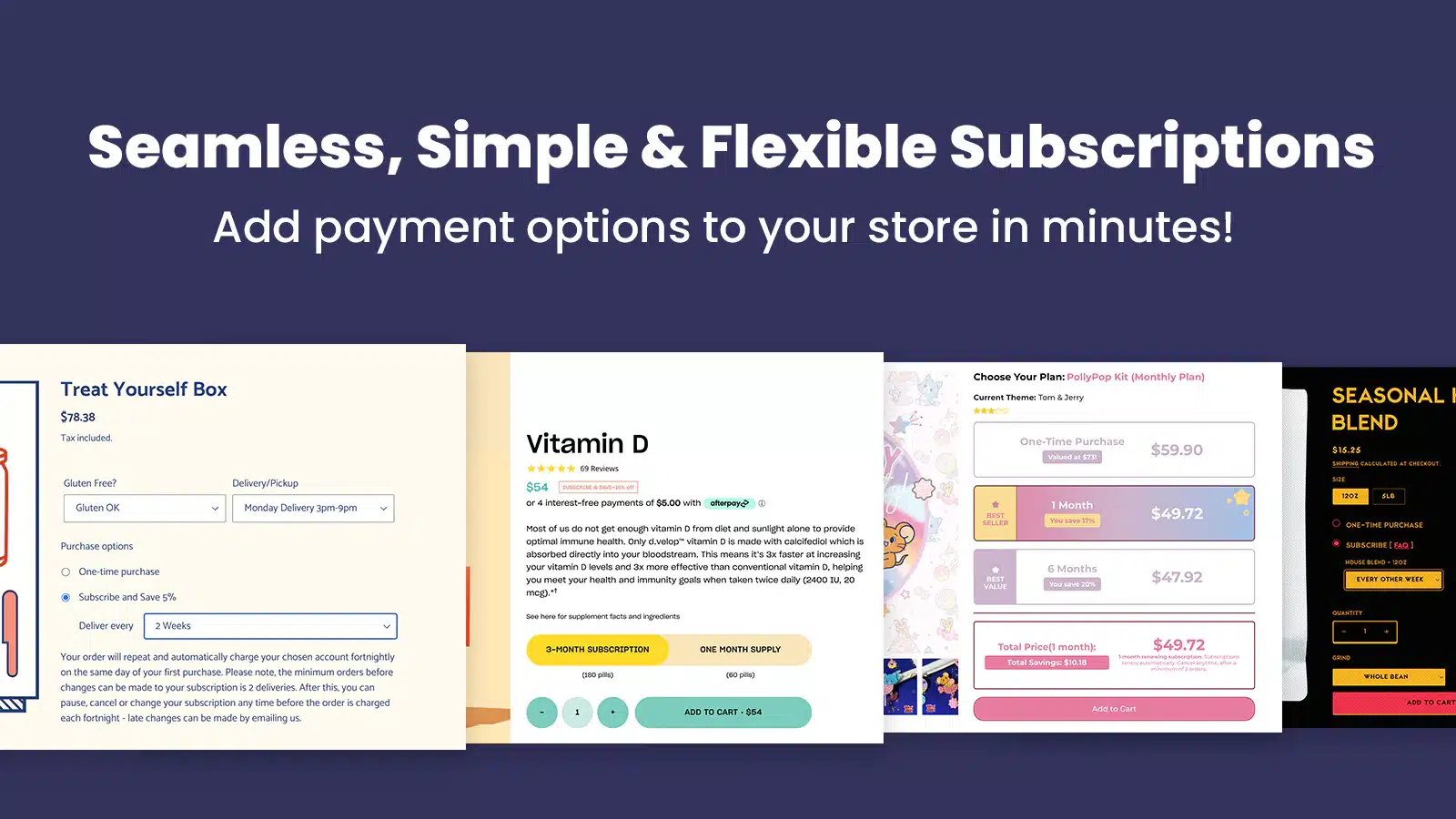

| 1 | PayWhirl Subscription Payments | PayWhirl Inc. | $9/month | 4.6/5 ⭐️ | yes |  |

Get app |

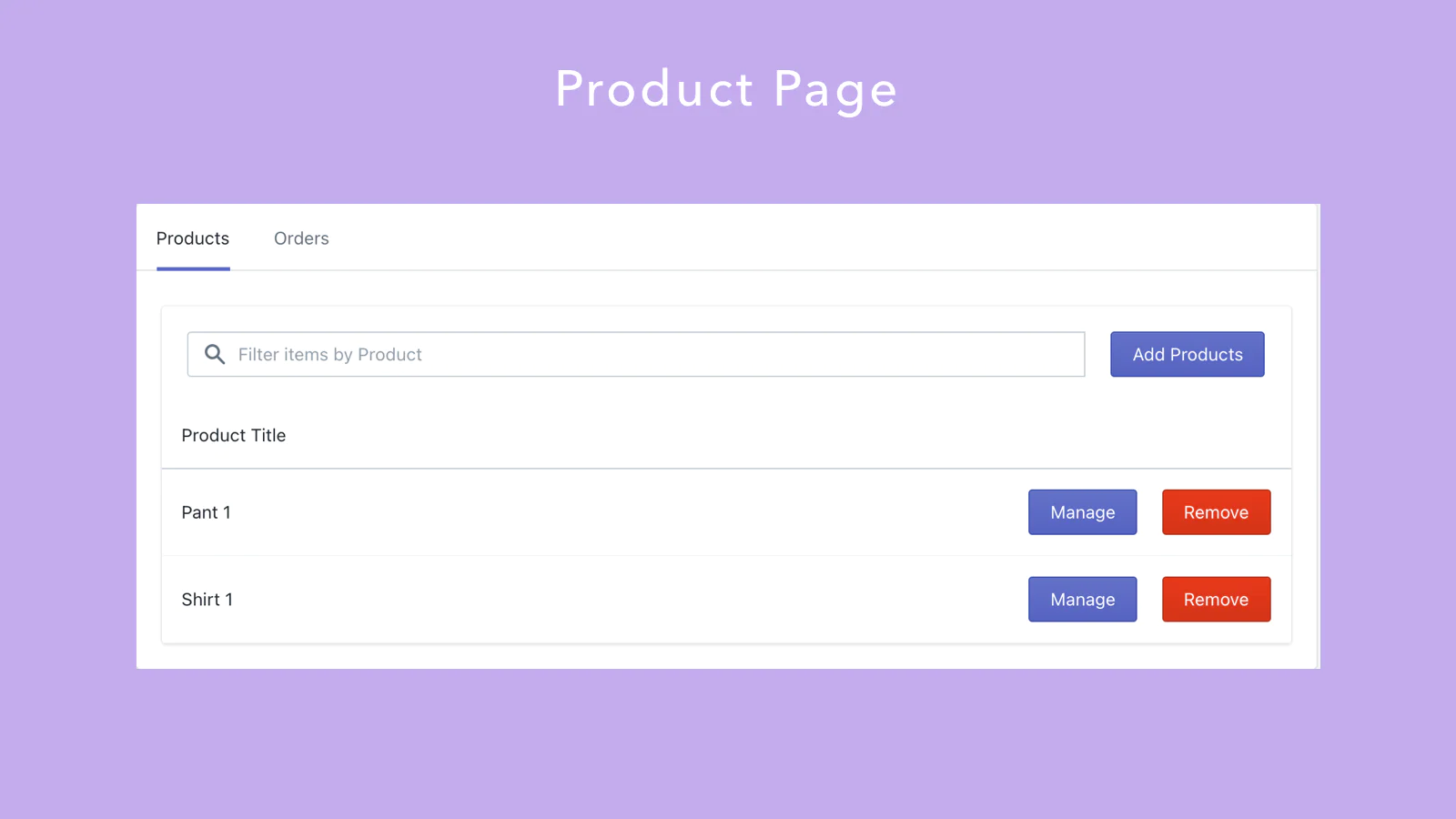

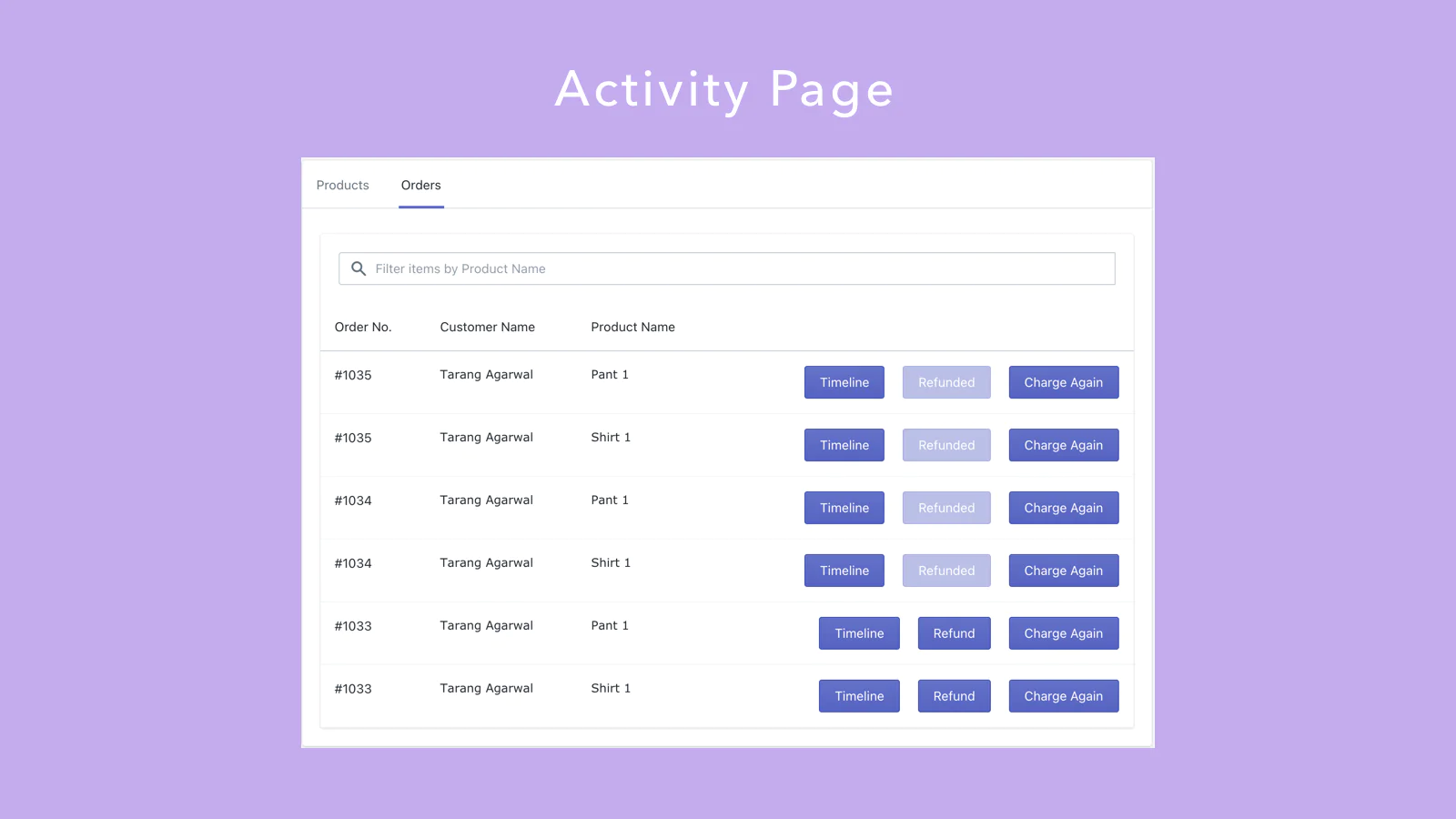

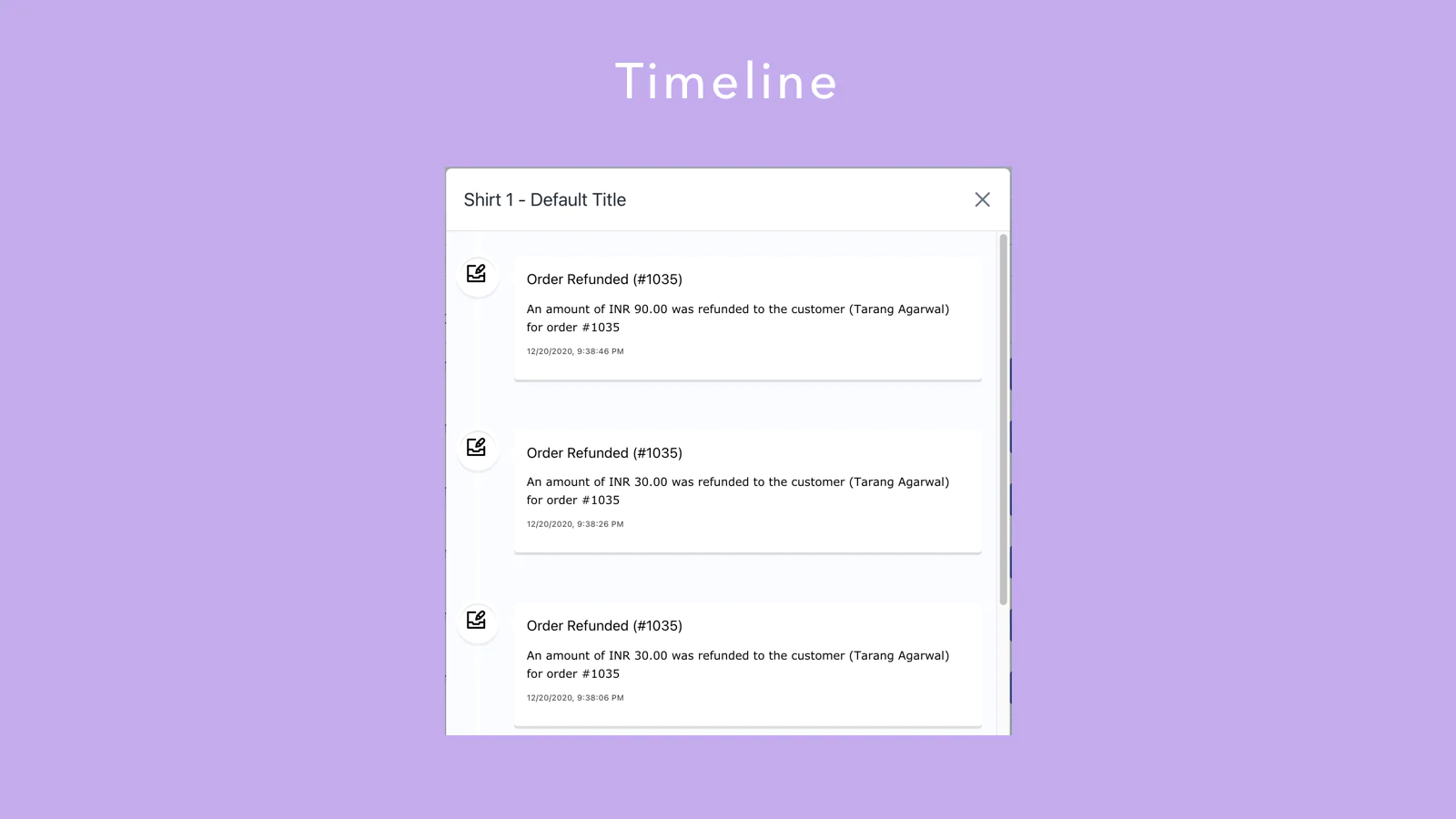

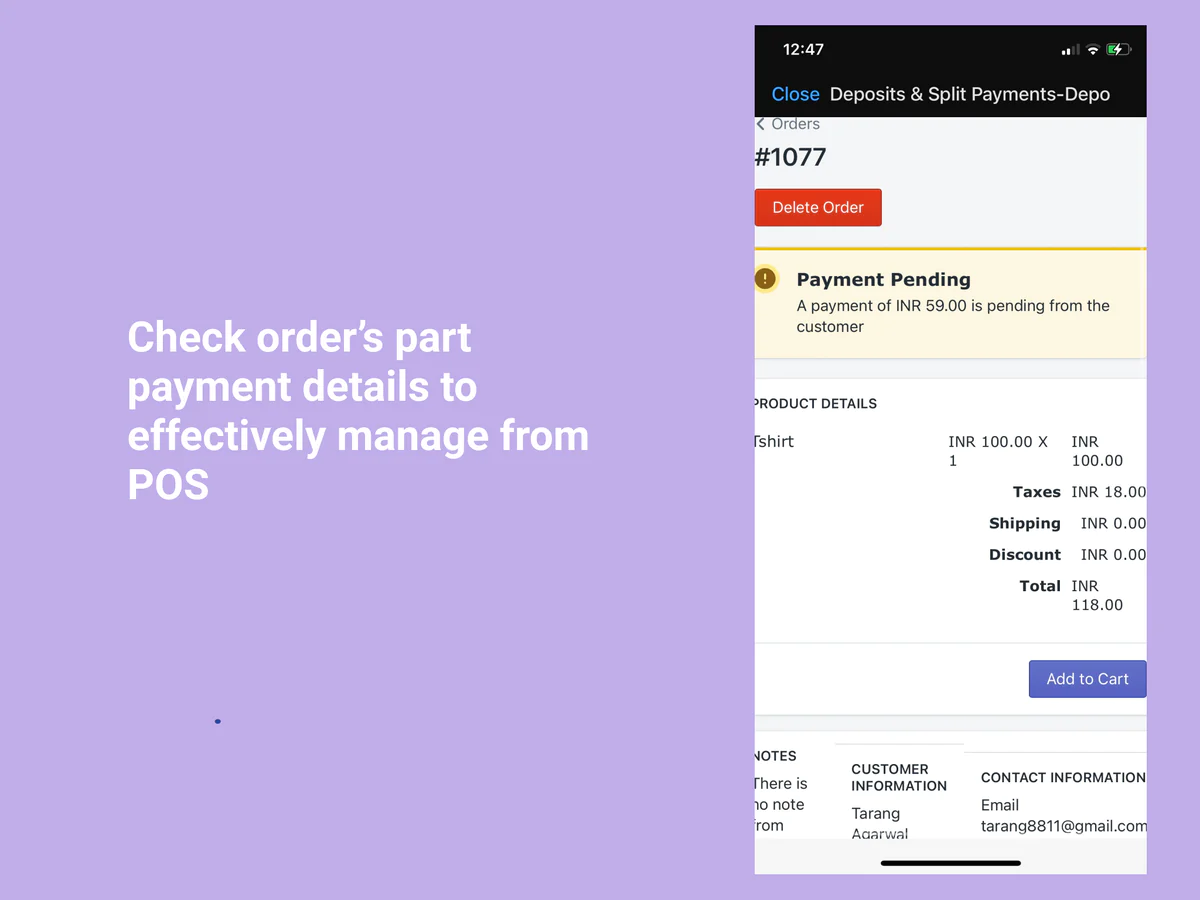

| 2 | Deposit & Split Payment Depo | Sidepanda Inc. | $12.50/month | 4.7/5 ⭐️ | yes |  |

Get app |

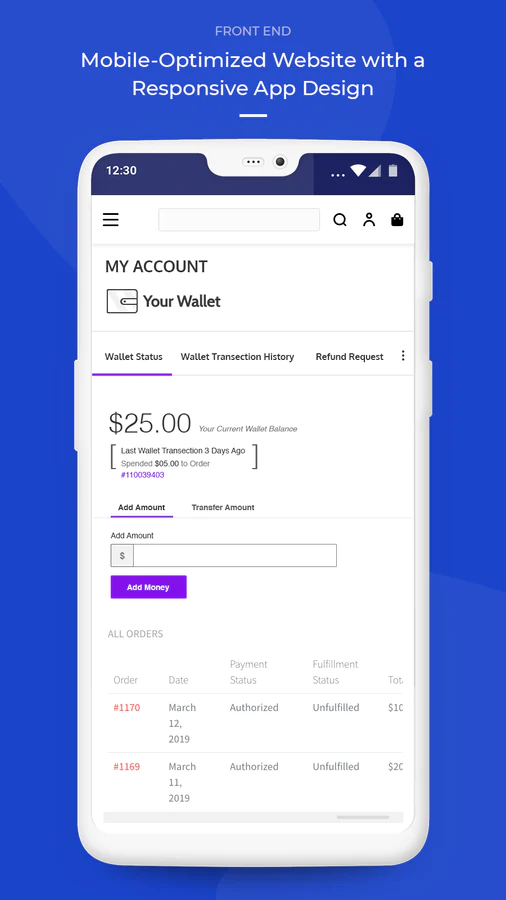

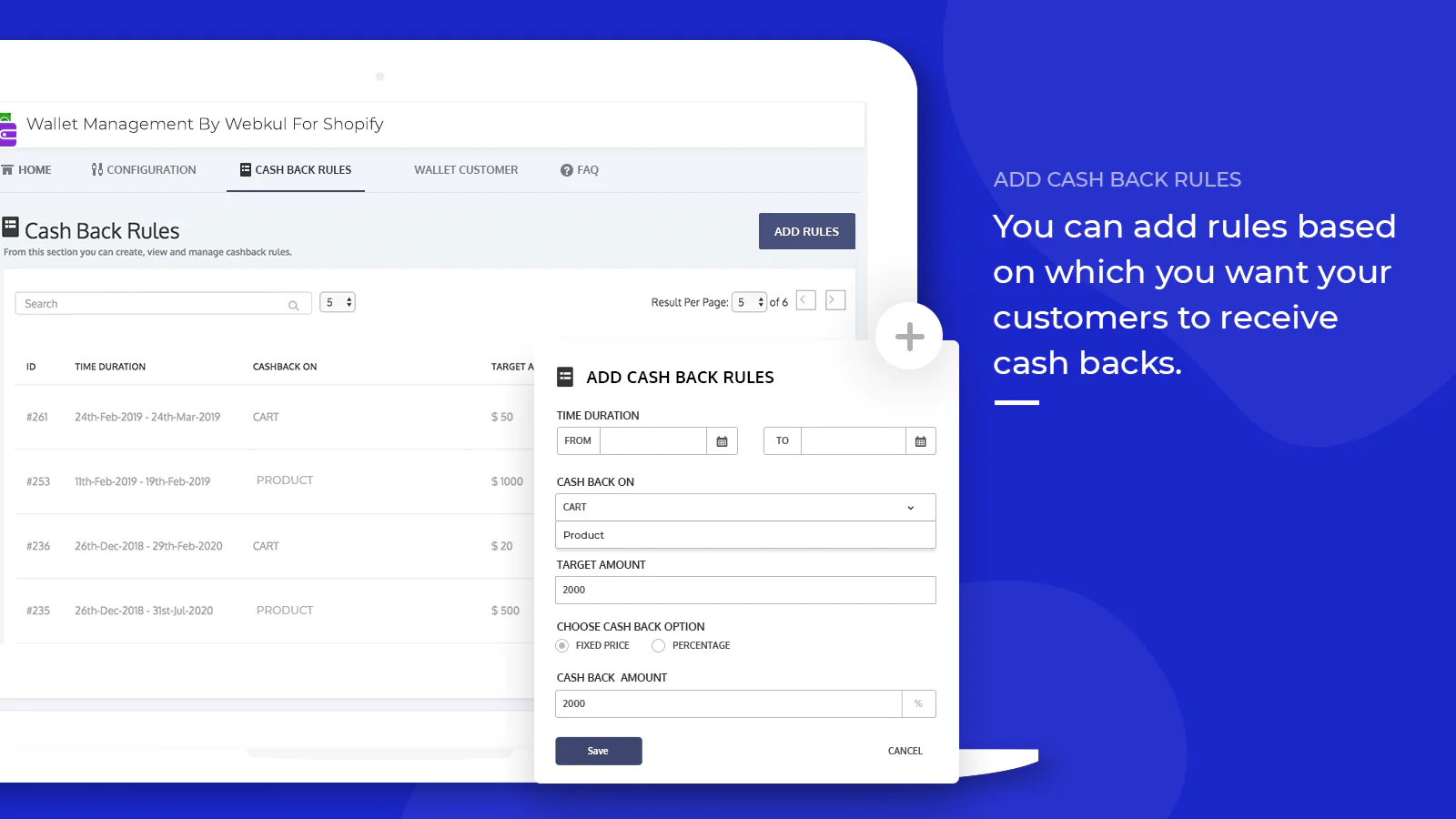

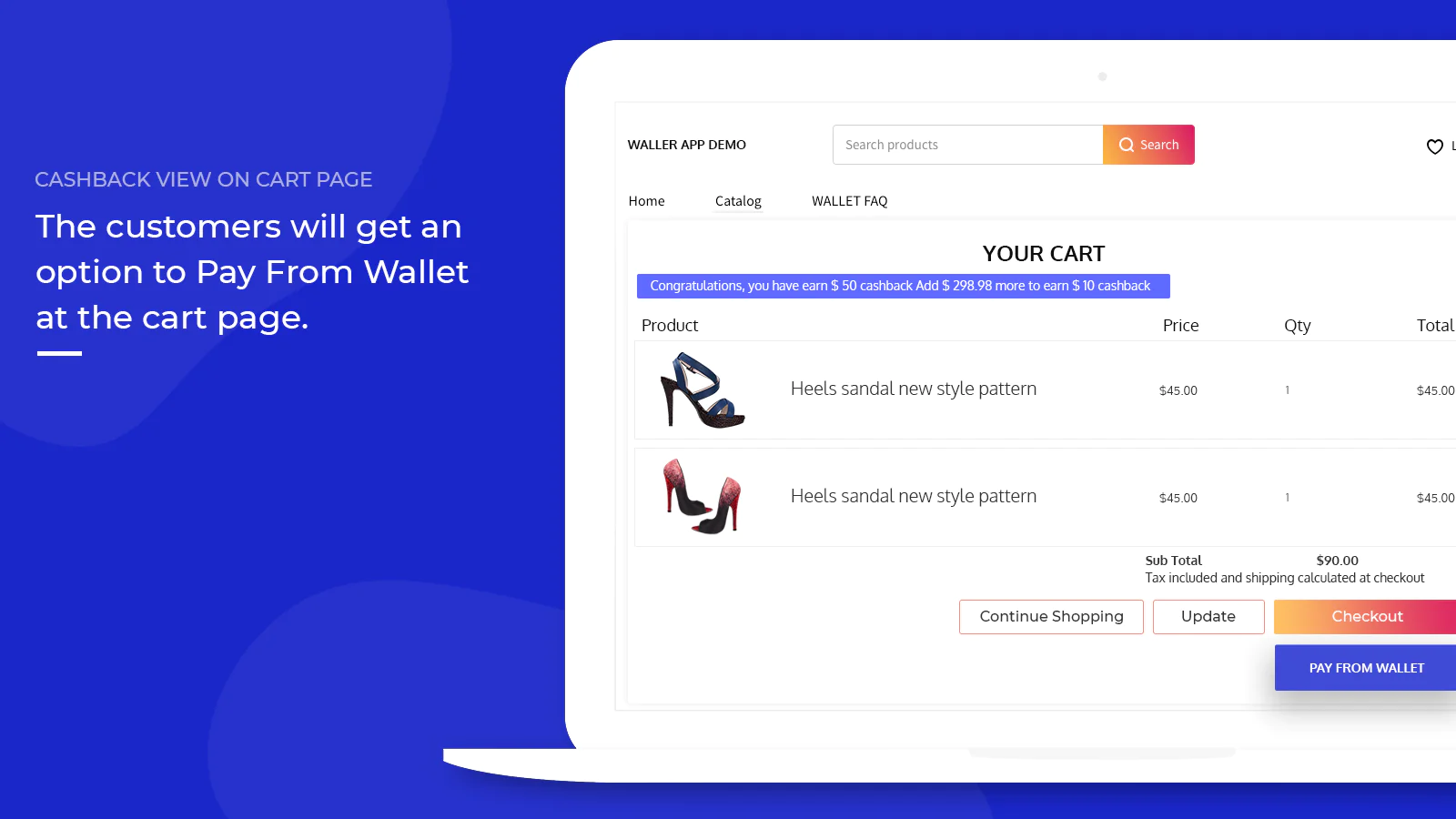

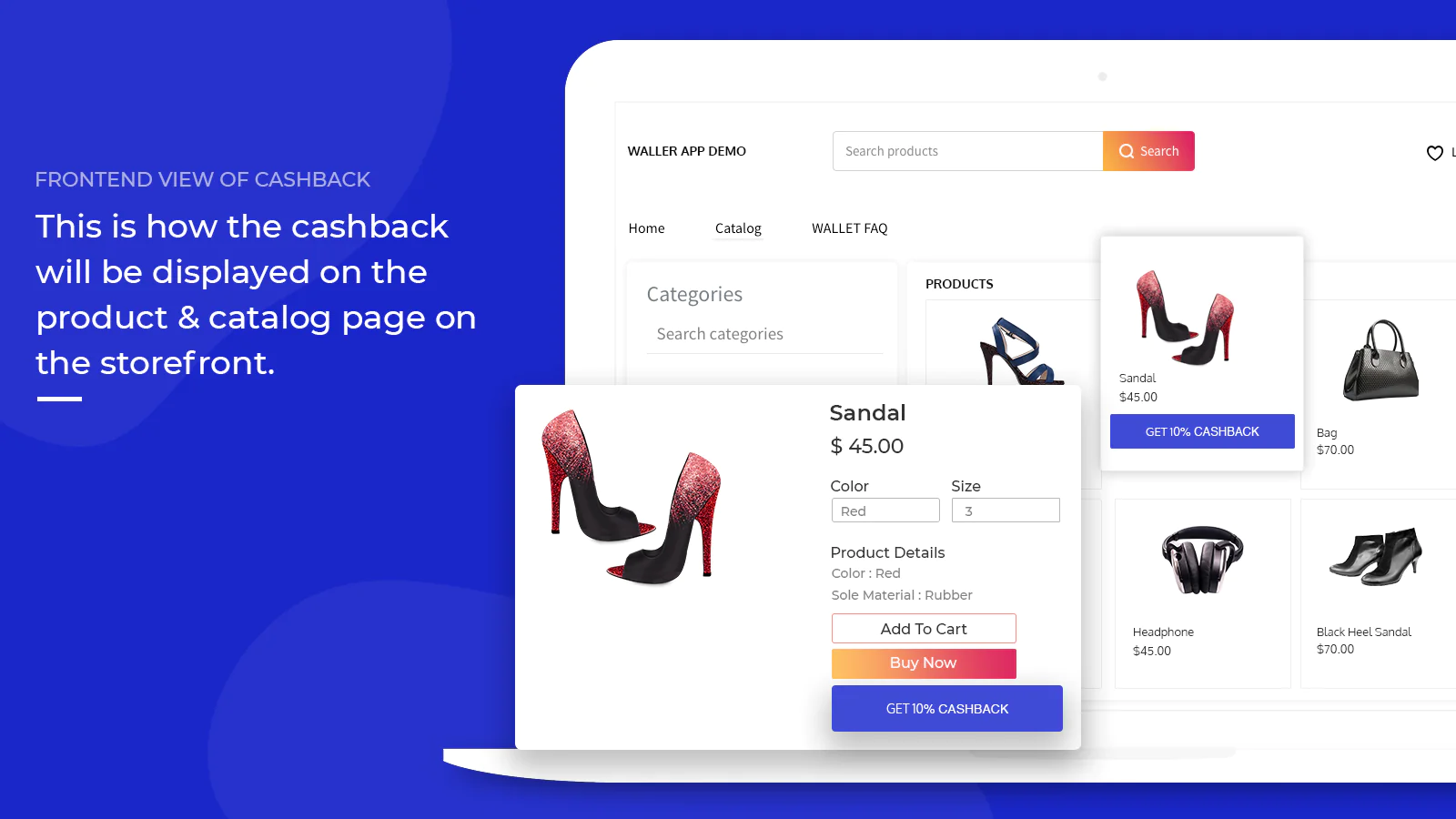

| 3 | Webkul Wallet Management | Webkul Software Pvt Ltd | $10/month | 4.8/5 ⭐️ | yes |  |

Get app |

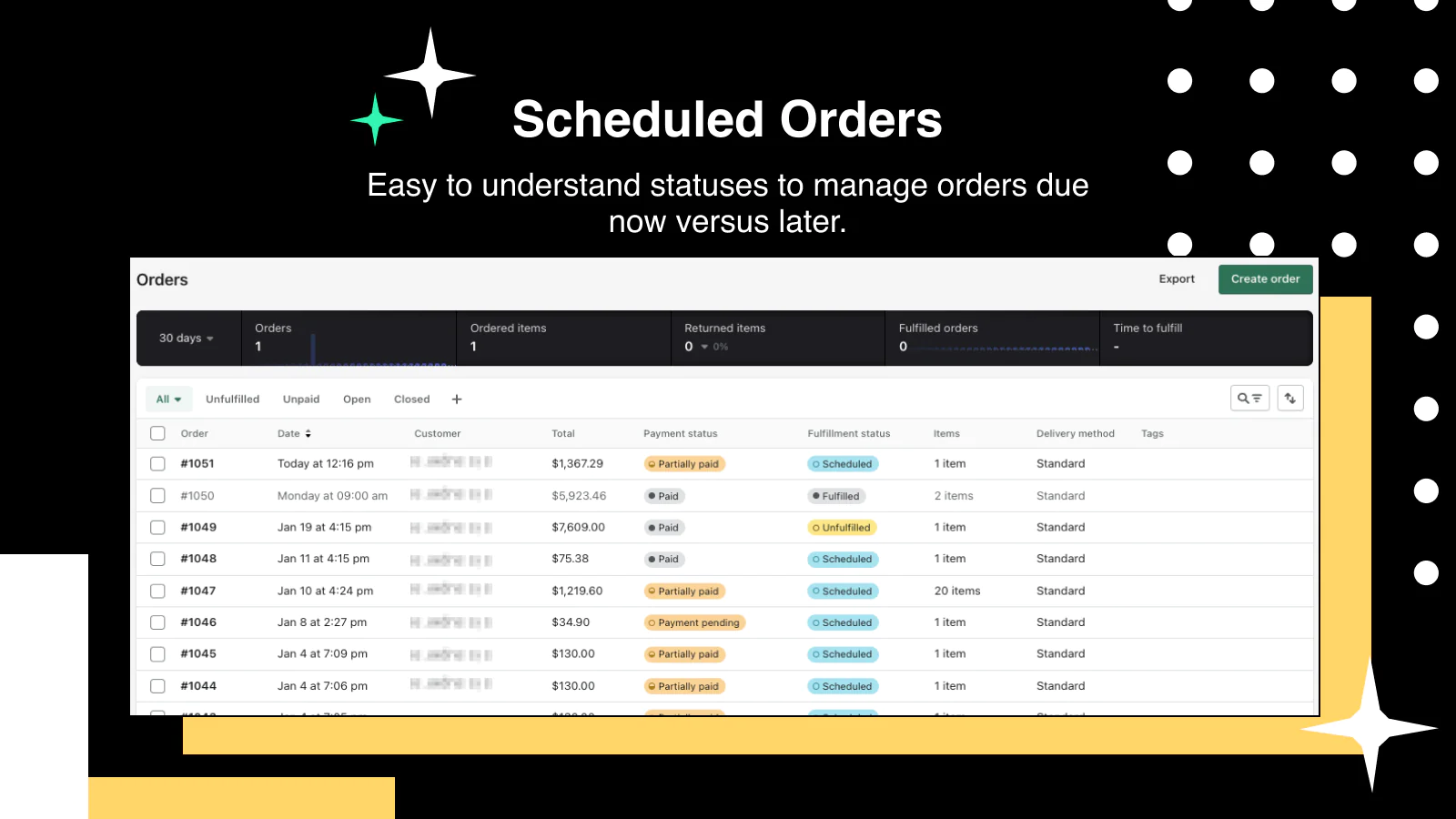

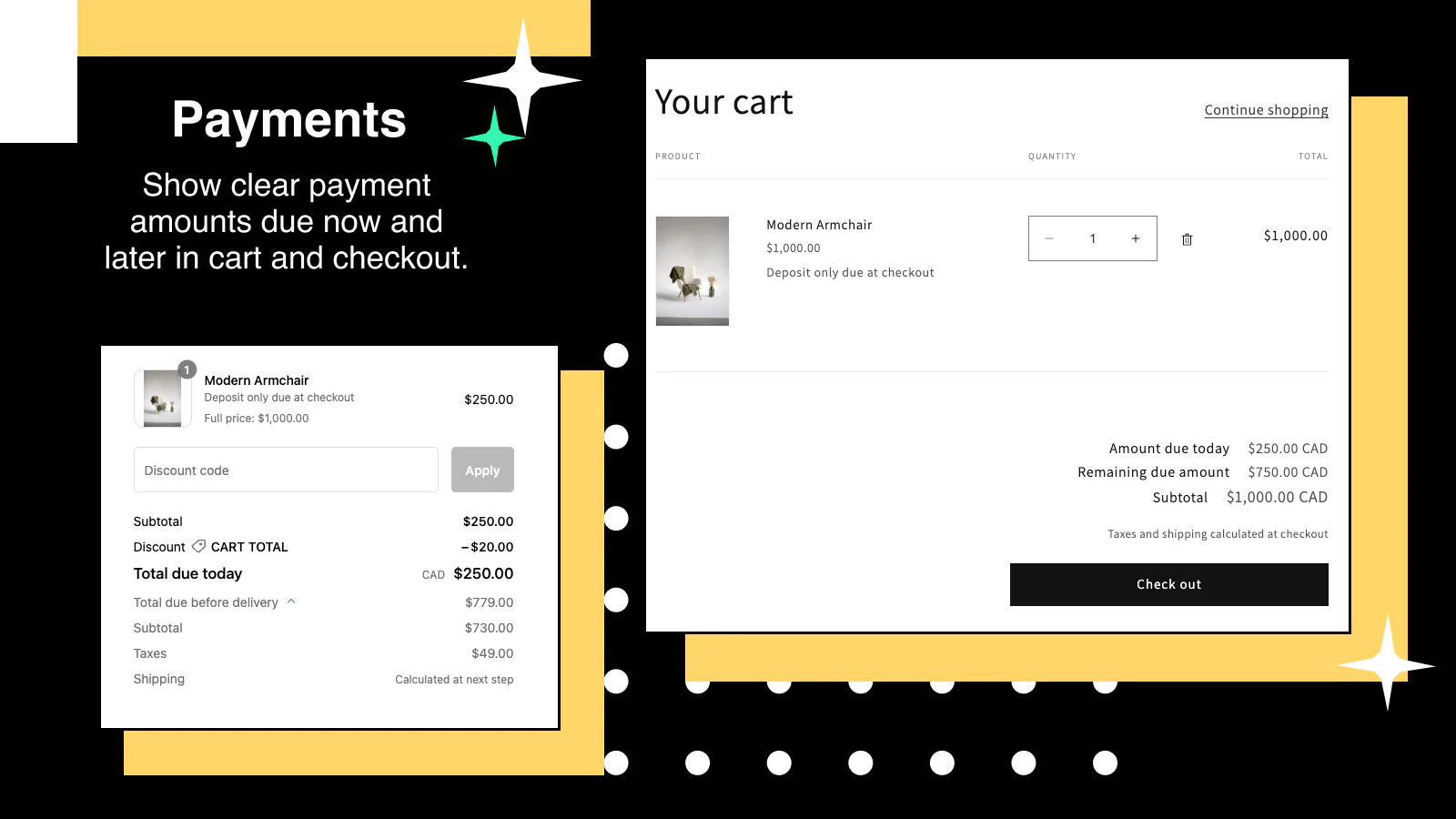

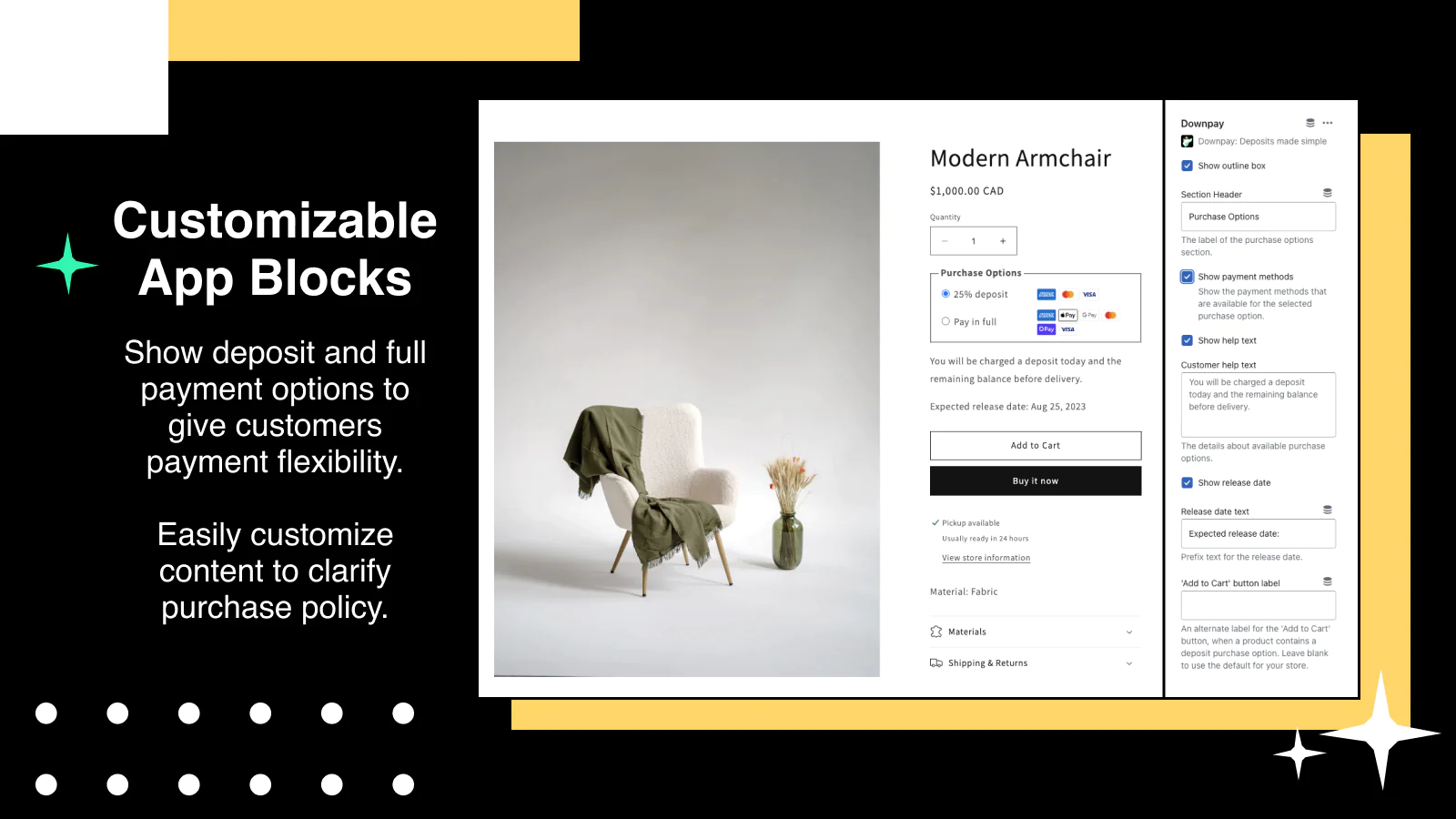

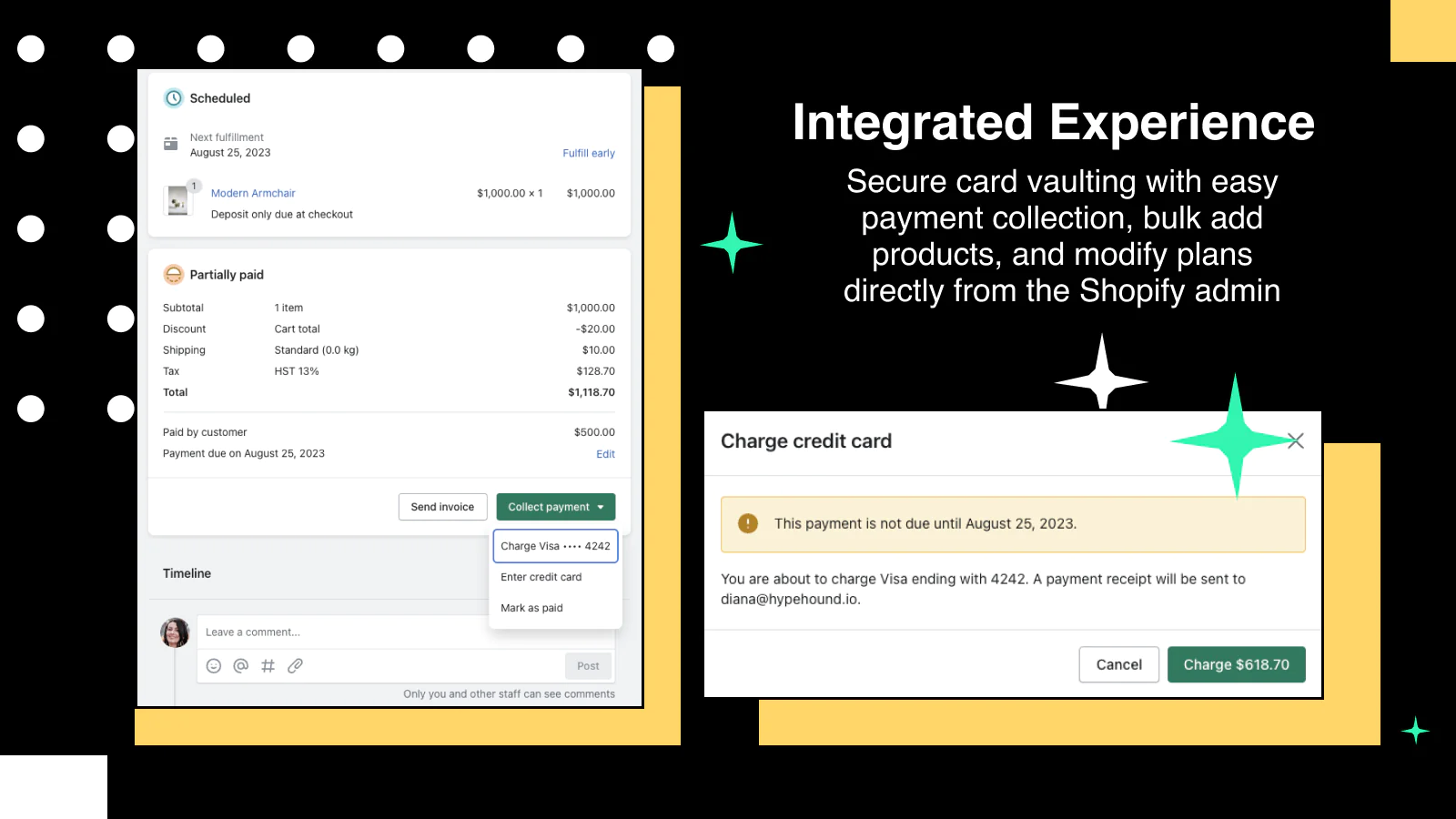

| 4 | Downpay: Deposits made simple | Hypehound | $9.99/month | 4.9/5 ⭐️ | yes |  |

Get app |

| 5 | Split Payment & Deposit SpurIT | SpurIT LLC | $17.95/month | 4.2/5 ⭐️ | yes |  |

Get app |

Top Shopify Payment apps reviewed

Table of contents:

How to Find The Best Payment Shopify App?

These five Payment apps for Shopify are ranked based on the following criteria:

- Features

- Price

- Rating on the Shopify app store

- Free trial availability

- Free app options

- Compatibility with other top apps

- Number of apps the app provider operates

- Pros and cons

- Built for Shopify badge

- Reviews and assessment by AcquireConvert

What are Shopify Payment apps?

Shopify payment apps are specialized applications that integrate with the Shopify admin to offer customized payment processing services to merchants. These apps are built by approved partners on Shopify’s Payments Platform and provide a variety of features to enhance the payment experience for both merchants and customers.

Key features of Shopify payment apps include the provision of additional payment methods, specific operations on payment methods, control over payment security for buyers, automation of services like recurring payments, and flexibility in fund capture timings. These apps make it possible for Shopify merchants to offer diverse payment options, automate aspects of the payment process, and ensure transaction security. Shopify Payments, Shopify’s own payment service, simplifies the process of accepting payments online by integrating directly with your Shopify account. This service is PCI compliant and supports 3D Secure checkouts, offering a safe and streamlined checkout experience for customers. With Shopify Payments, merchants can easily track orders and payments in one place, gaining a comprehensive view of their finances.

Additionally, there are various third-party payment apps available for Shopify stores, each with its own set of features, pros, and cons. These apps include PayPal, Stripe, Authorize.net, Opayo, Verifone, and Worldpay, among others. They offer different benefits such as support for international transactions, customizable checkout experiences, fraud prevention measures, and API-driven integration with other systems. However, they also come with their own challenges, such as varying transaction fees, limited availability in some regions, and requirements for technical knowledge in some cases.

What is the most used payment method in Shopify?

The most commonly used payment method in Shopify is credit and debit card payments. This is primarily because these forms of payment are widely accepted and familiar to most customers. Credit card companies such as Visa, Mastercard, American Express, and Discover extend credit to purchasers, covering the purchase price, with customers then paying off their card balance each month. Debit cards, on the other hand, deduct money directly from the purchaser’s bank account.

While credit and debit card payments offer advantages like convenience and the ability for customers to make larger purchases even if they don’t have a lot of cash on hand, there are some disadvantages as well. One of the main downsides for merchants is the payment processing fees charged by credit card companies, which can vary. Additionally, there is often a delay between the time of purchase and when the transaction amount appears in the merchant’s bank account, in contrast to immediate payment methods like cash.

Shopify also supports various other payment methods, including cash, mobile wallet services (like Apple Pay, Google Pay, and Samsung Pay), buy now, pay later (BNPL) plans, checks, bank transfers, autopay, and cryptocurrency. Each of these payment methods has its own set of advantages and disadvantages, and the choice of which to use can depend on the merchant’s business model and customer preferences.

Is Shopify Payments the best option?

Deciding if Shopify Payments is the best option for a Shopify store requires considering the business’s specific needs and customer preferences. Shopify Payments, an integrated payment service, enables immediate payment processing after sign-up. It supports multiple payment methods like major credit cards, PayPal, Apple Pay, and Google Pay, offering competitive processing rates. This integration provides a effortless checkout experience and keeps payment and sales information within the Shopify ecosystem.

However, Shopify Payments also has limitations. It’s not available in all countries and excludes businesses in certain high-risk industries. Merchants have reported sudden account terminations and funding holds. Furthermore, Shopify Payments imposes stricter rules on the types of businesses it serves, prohibiting a range of products and services. Businesses can use other payment gateways alongside Shopify Payments, but these third-party providers incur transaction fees. Alternative payment gateways like PayPal, Square, and Authorize.net offer different features and pricing, catering to various business needs.

Ultimately, while Shopify Payments offers convenience and integration for many Shopify merchants, it might not suit every business. Merchants need to evaluate their specific requirements and consider other payment options if Shopify Payments doesn’t align with their needs.

Conclusion: Best Shopify Payment Apps

It requires time and effort to compare and evaluate features of the various different Payment Shopify apps to find the ideal option.

Shopify store owners must evaluate relevant information to make the optimal choice for their needs.

This guide does the challenging work for merchants by comparing and evaluating the top choices for different Payment Shopify apps. The results of our analysis of the best Payment Shopify apps are listed below: