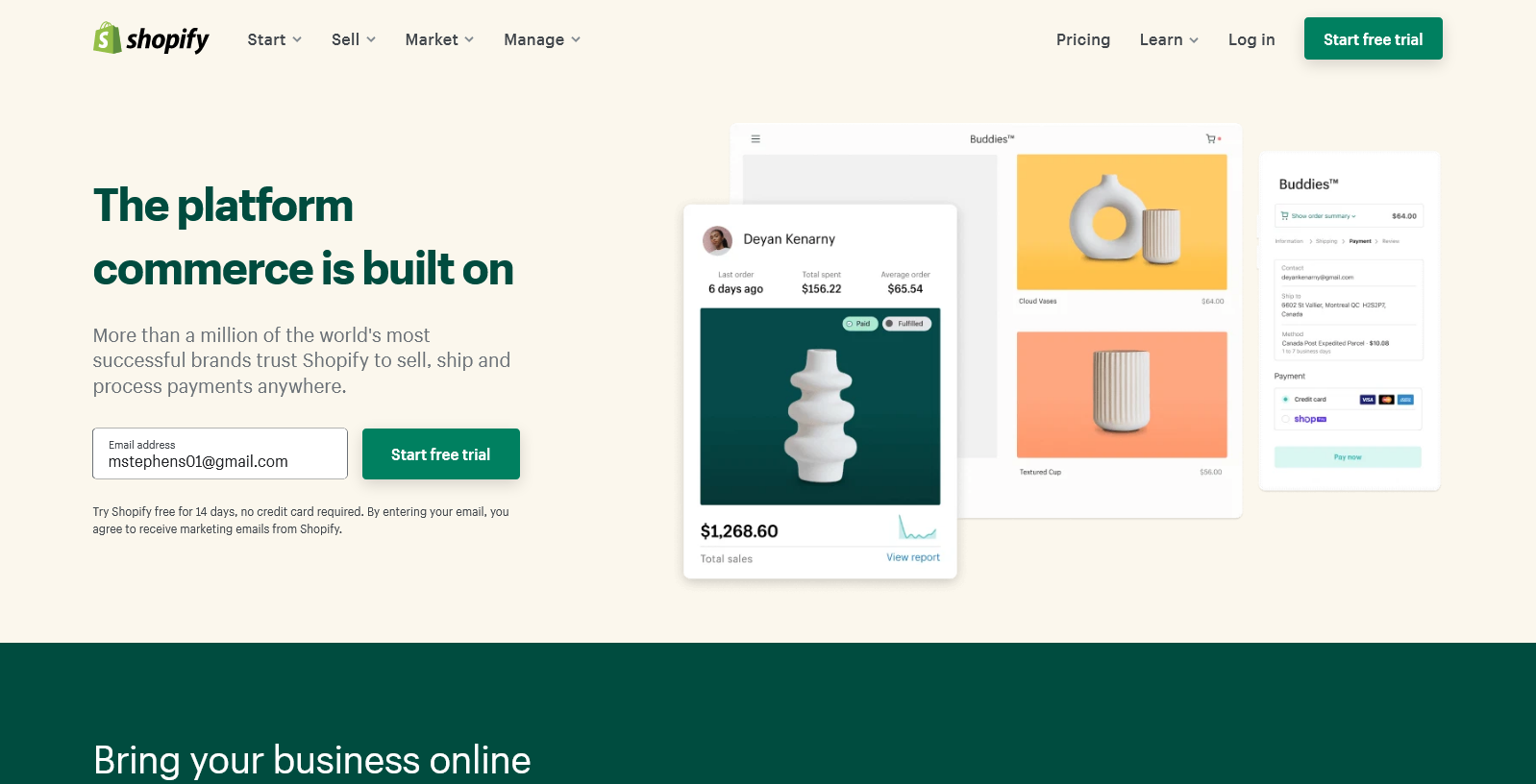

Shopify

The focus of Shopify is purely on ecommerce, providing a cloud-based, multichannel commerce platform for small and medium-sized businesses.

Through Shopify and Shopify Plus, the platform caters to stores in all stages of the growth cycle from startup to established business competing with the biggest and best.

Shopify provides access to over 100 professional themes that can be used to build and manage online stores – with increasing numbers of mobile-first themes and easy integration with social media channels.

A vast array of apps can plug into the Shopify software to enable extra functionality, more customization, and a better all-round user experience. The company is also focused on leading ecommerce into the future with increasing opportunities for its merchants to sell across international borders without impediment.

Shopify also increasingly provides Point of Sale (POS) solutions to allow an integrated, single view of online and offline transactions.

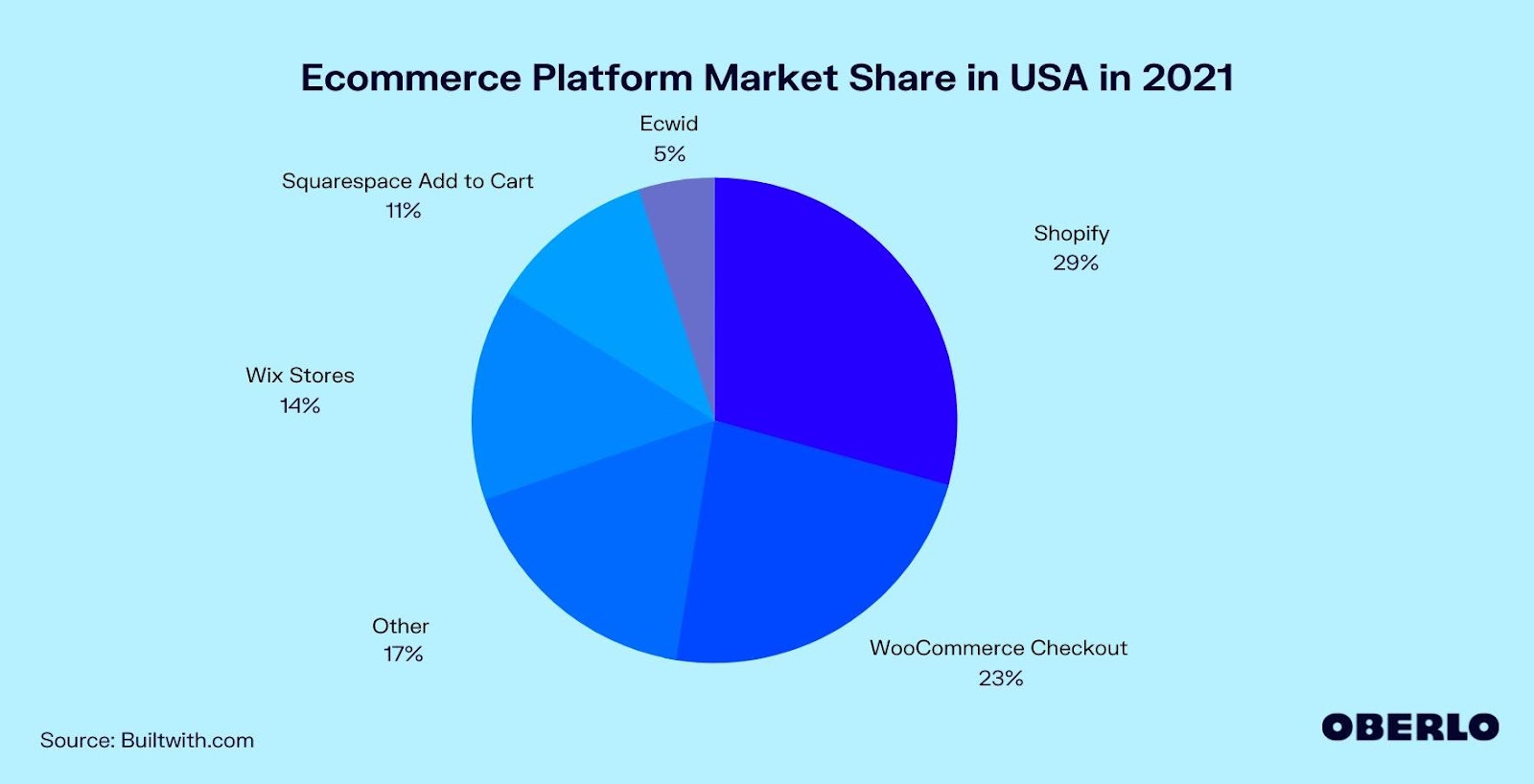

Shopify currently enjoys a whopping 29 percent of market share in the U.S., making it the largest single ecommerce platform in the region, recently moving ahead of WooCommerce.

Kartrocket

KartRocket brands itself as online “website builder” software for ecommerce stores. The focus is on smaller stores and startups that are looking to customize their stores using over 100 design templates.

It allows API integration and supports data import from multiple platforms. Particular strengths lie in cataloging, store management, multi-vendor management, shipping, inventory tracking, and website SEO optimization.

The international market share of Kartrocket is much lower than Shopify, with many of its leading clients based on the Indian subcontinent. The platform has developed its name in India and, unlike Shopify, is barely known in the U.S. market.

Main features: Shopify vs Kartrocket

Shopify

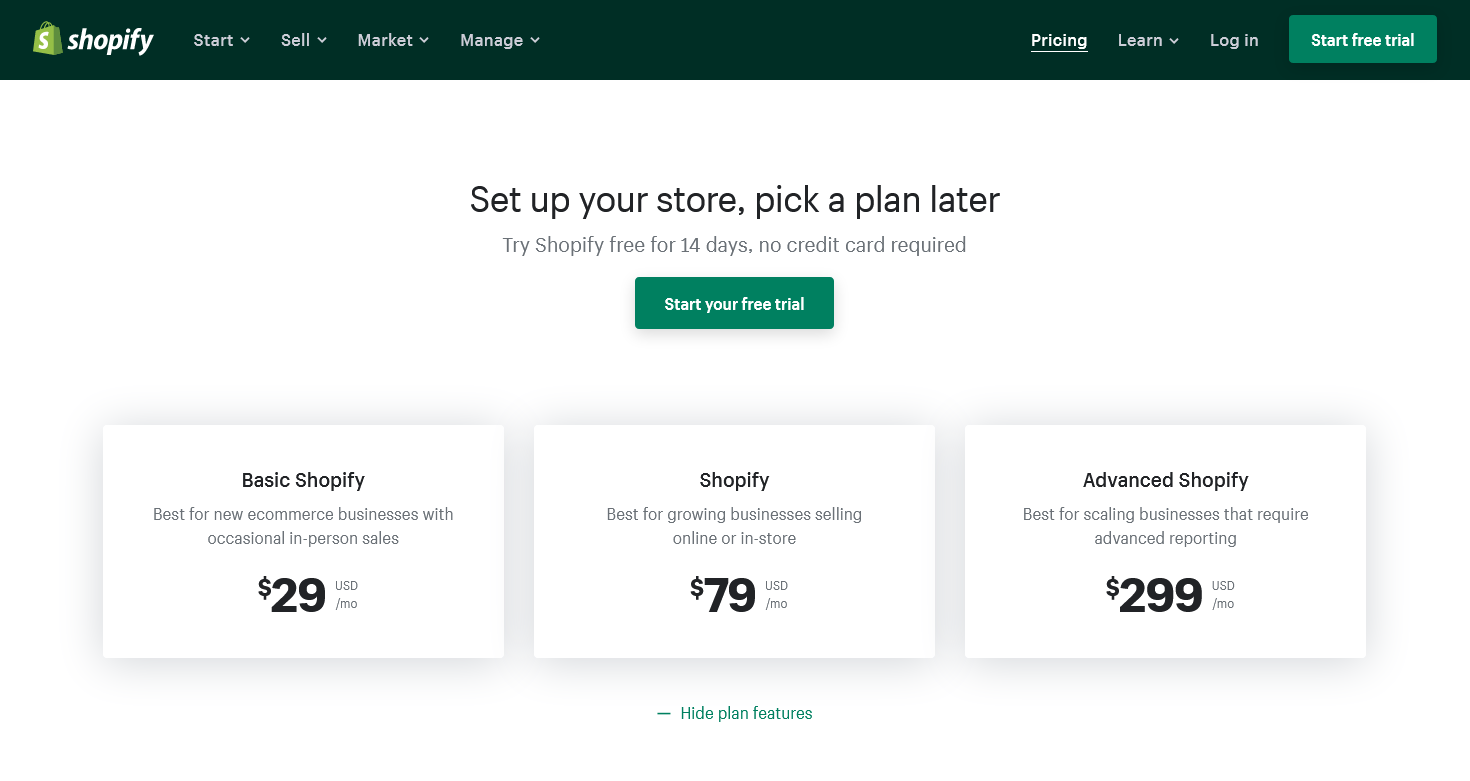

Shopify offers several different plan options from a basic Shopify plan to an Advanced plan and Shopify Plus for larger stores and enterprises.

Even the basic plan provides all of the necessary features for store owners to run a successful online business. These includes:

- Unlimited products, bandwidth, and online storage

- Ability to customize your store

- Built-in theme editor to easily edit your online store’s fonts, colors, and page layouts without coding

- Theme-editing tutorials and Shopify Experts available to help

- Add up to 20 themes on one Shopify account

- Manage products, orders, and customer information from a single Shopify admin panel

- Abandoned cart features

- Built-in blogging engine for publishing articles and updates for customers

- SSL certificate to keep information secure

- Between 2 and 15 staff accounts available (depending on the plan)

- Encryption of content and secure publishing using HTTPS

- Finance reports, acquisition reports, behavior reports, and marketing reports for your store

- Insight into store traffic to help grow your store

- Engage customers with promotions (discount codes) and gift card management

- Vast app ecosystem to improve the customer experience, marketing, store management, etc.

- Fraud analysis

- Global selling opportunities (standard Shopify plan and higher)

All Shopify plans provide point-of-sale options, while the higher-level plans provide more advanced reporting and integration with third-party shipping services to enable stores to provide customers with up-to-date shipping rates when they place orders.

Shopify even offers a Lite plan, which allows you to sell products without maintaining an online store: simply embed a Buy button on a personal website or blog.

Kartrocket

Kartrocket’s features are best divided into four main categories:

Order and inventory management

- Single view for all orders and inventory

- Real-time shipment and stock notification

- Automated order assignment system

- Customized post-purchase tracking page

Customer relationship management

- Customer profiling and segmentation

- Product recommendation engine

- Dynamic transactional emails

- Real-time push notifications

- Abandoned cart reminders

Data and artificial intelligence

- Automatic “bought together” and “similar products” suggestions

- Customized courier recommendation engine

- Low inventory alert

- Store credit system to reward loyal customers

- Advanced checkout page with couriers and payment options

Ecommerce catalogue management

- A fully customizable product page

- Ability to show product variations and size/color filters

- Bulk upload and categorization

- Product comparison tool

- Ability to show discounted rates

- Order limit and wishlist feature

Support: Shopify vs Kartrocket

We all know how important support is in ecommerce, where so much can go wrong so quickly. The quality of support is often cited as a key reason to change platforms, all other things being equal.

Both Shopify and Kartrocket offer phone support, live chat and email support, with educational resources also provided. This can be especially important to startups just feeling their way with their new store.

Kartrocket offers assistance in English with installation, training, troubleshooting, and help with upgrading or canceling a product or service.

Shopify also provides setup and troubleshooting assistance via the support team by phone, email, or chat. The 24/7 live chat and phone support are available in English only but 24/7 email support is available in over 20 languages, which gives it an edge over Kartrocket for international stores.

Pricing: Shopify vs Kartrocket

Shopify pricing is as follows:

This is quite straightforward: The basic plan for startups is at $29/month, the standard Shopify plan for growing stores is $79/month, and the Advanced plan with advanced reporting comes in at $299/month.

If you don’t use the Shopify Payments feature, there are also transaction fees to pay for each sale.

Kartrocket pricing is harder to pin down as it’s not detailed on their website. However, a little research suggests that the Essential plan, which is the basic starter plan, comes in at $51/month – a slightly higher starting point than Shopify. This includes up to 5,000 products, three staff accounts, and limited app store access.

Other plans at $102/month (Premium), $174/month (Platinum) and $363/month (a customized Enterprise solution) are also available with Kartrocket.

For all Kartrocket plans, a minimum 12-month signing period applies.

Free trials?

A 14-day free trial is available with Shopify.

Currently, no free trial is offered by Kartrocket. To find out more about the platform, you need to get in touch for a consultation.

Shopify and Kartrocket: looking to dominate their respective markets

Over the past decade or so, both Shopify and Kartrocket have established themselves in their respective markets and both have seen incredible growth in the past two years in particular.

Whereas Shopify has successfully expanded out from its core market in North America (the U.S. and Canada) and become a major world player in ecommerce, Kartrocket is still attempting to do that from its base in India.

Shopify has a strong lead in market share and the scalability features that it offers – and with good reason. The platform is backed by considerable resources and seems to be pioneering ecommerce with innovative solutions similar to those provided by Amazon in the very early days of ecommerce.

As Kartrocket grows, it will look to do the same in Asia as Shopify has achieved in North America and beyond in recent years.

Extra charges associated with the main credit providers like Visa, Mastercard, AMEX, etc. have made buying on credit expensive. Besides, not everyone has credit cards and many actively avoid owning one – especially millennials. According to

Extra charges associated with the main credit providers like Visa, Mastercard, AMEX, etc. have made buying on credit expensive. Besides, not everyone has credit cards and many actively avoid owning one – especially millennials. According to